Public opinion survey

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Canadian Businesses and Privacy-Related Issues

Final Report

Prepared for the Office of the Privacy Commissioner of Canada

Phoenix SPI

December 2013

Executive Summary

Phoenix SPI was commissioned by the Office of the Privacy Commissioner of Canada (OPC) to conduct quantitative research with Canadian businesses on privacy-related issues. The purpose was to better understand the extent to which businesses are familiar with privacy issues and requirements, and the types of privacy policies and practices that they have in place. A 15-minute telephone survey was administered to 1,006 companies across Canada, stratified by size of business. The results were weighted by size, sector and region using Statistics Canada data to ensure that they reflect the actual distribution of businesses in Canada. Data collection was conducted November 7-27, 2013. Based on a sample of this size, the results can be considered accurate to within ±3.1%, 19 times out of 20. Results are compared to similar surveys conducted in 2007, 2010 and 2011. The 2013 survey includes modifications to the questionnaire to address the evolving privacy environment.

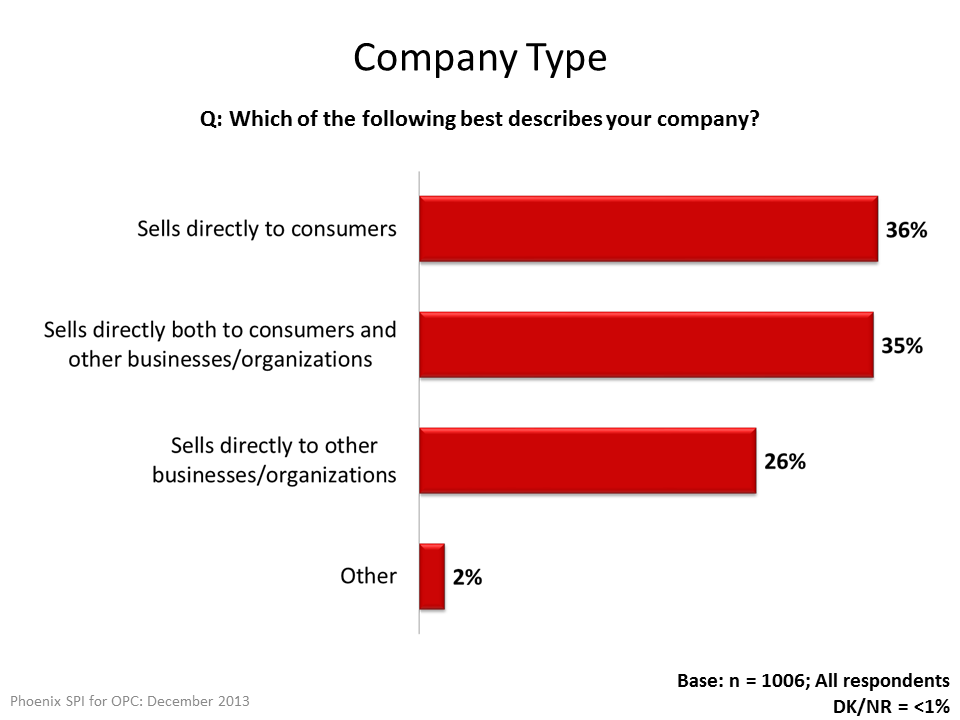

Collection and Storage of Personal Information

Surveyed business representatives work for a mix of different companies in terms of the type of customers served. In total, 36% of these companies sell directly to consumers (i.e., members of the general public or some subset of it). Almost as many (35%) sell both to the general public and to other businesses/organizations. Approximately one-quarter (26%) sell only to other businesses/organizations.

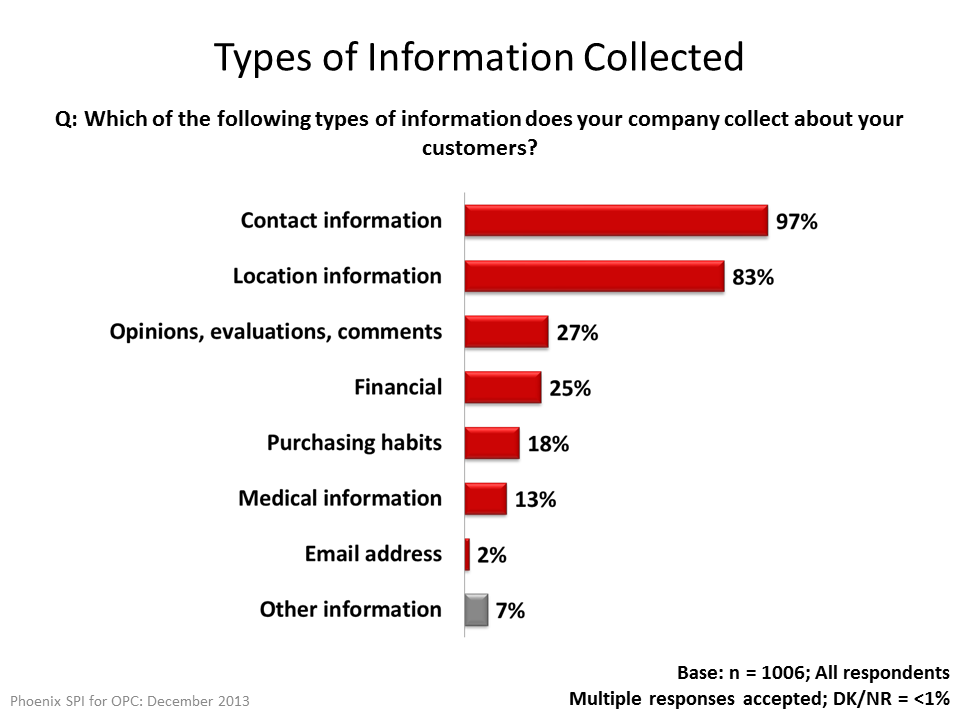

In terms of the types of customer information collected, virtually all of the surveyed companies (97%) collect contact information, such as names, phone numbers, and addresses. The large majority (83%) collect location information, such as postal codes. Other types of information mentioned with some frequency include opinions, evaluations, and comments (27%), financial information, such as invoices credit cards, or banking records (25%), purchasing habits (18%), and medical information (13%). In terms of diversity of information collected, most companies (65%) collect either two (39%) or three (26%) different categories of information mentioned above. A quarter (24%) collect more than that, while 11% collect less.

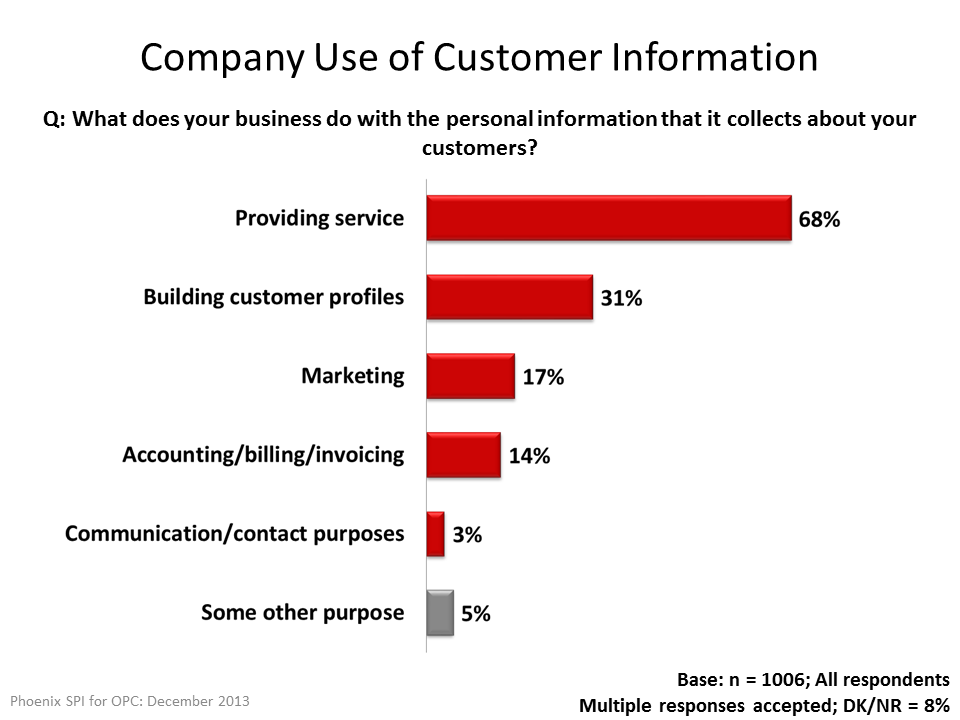

Approximately two-thirds (68%) of Canadian businesses use customers’ personal information to help provide service to those customers. Slightly less than one-third (31%) use it to build customer profiles. Also mentioned with some frequency are marketing (17%) and use for financial matters, such as accounting, billing and invoicing (14%).

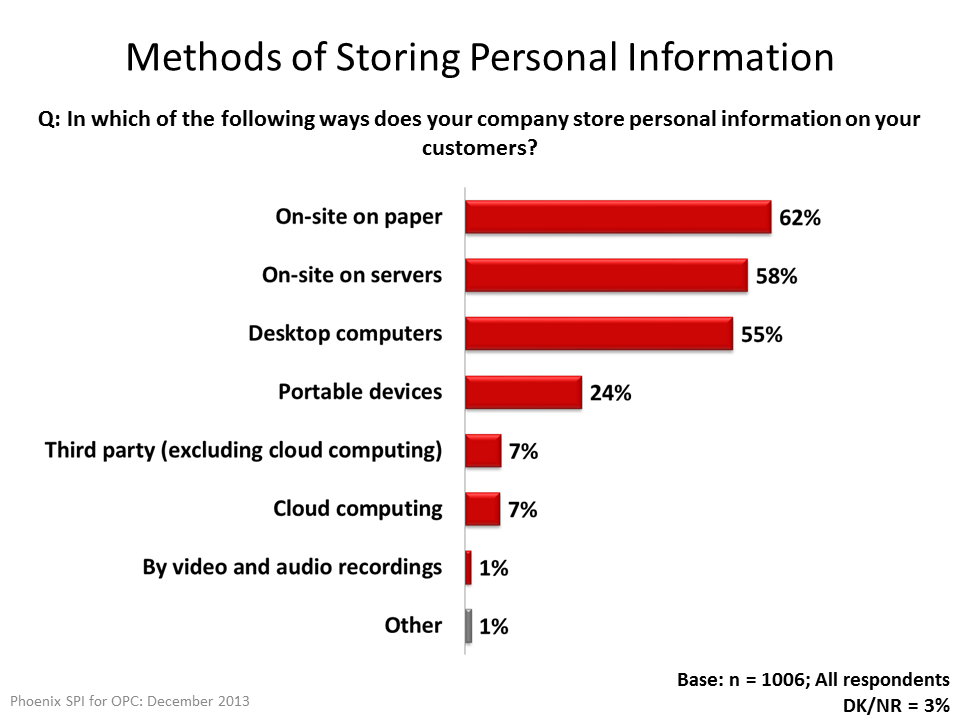

Three methods are commonly used by Canadian businesses to store personal information about their customers, each identified by a clear majority of business representatives. These include paper records stored on site (62%), the use of on-site servers (58%), and the use of desktop computers (55%). No other methods came close. Nearly one-quarter (24%) use portable devices, such as laptops, USB sticks, or tablets, while smaller numbers use cloud computing (7%) or a third party (excluding cloud computing) (7%).

Personal Information Protection Practices

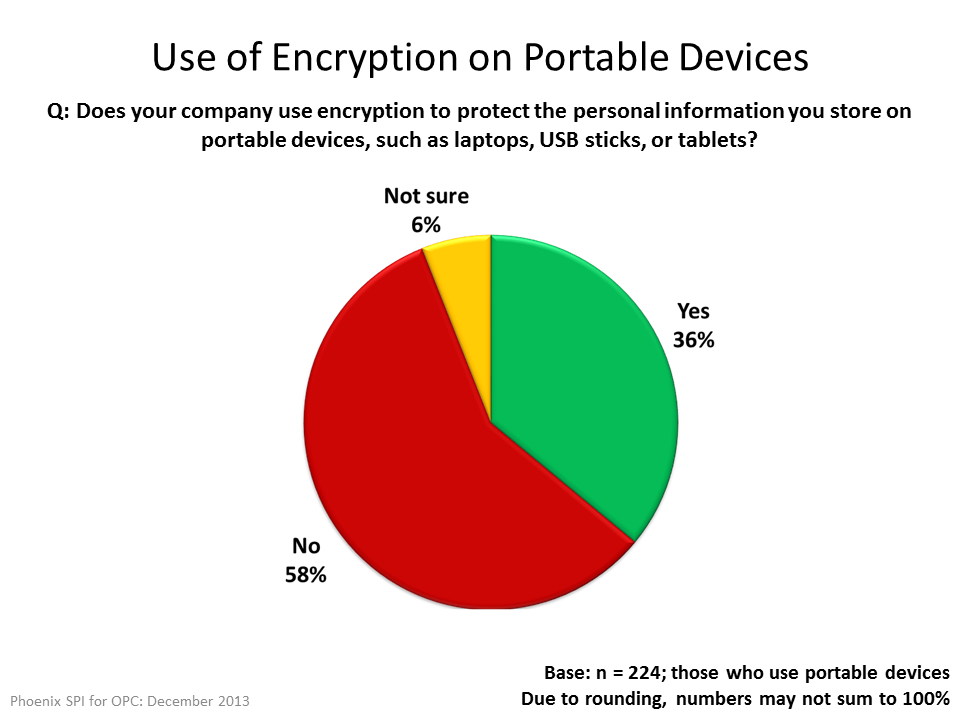

Business executives whose firms use portable devices, such as laptops, USB sticks, or tablets, to store their customers’ personal information were asked whether or not their company uses encryption to protect information stored in this way. In response, 36% said that they did, whereas 58% said they did not (6% were uncertain).

Canadian businesses use a number of methods to protect the personal information of their customers. More than three-quarters use technological tools, such as passwords, encryption, or firewalls (78%), or physical measures, such as locked filing cabinets, restricting access, or security alarms (78%). Almost two-thirds (65%) use organizational controls, such as policies and procedures. Of those that use technological tools to protect customer information, almost everyone (98%) uses passwords. As well, 82% use firewalls, while 48% use encryption. Of businesses that use passwords, 55% have controls in place to ensure that employees use hard-to-guess passwords. Also, most require their employees to change their passwords: 21% require this monthly, 17% quarterly, 10% every six months, 10% yearly, and 6% less than this (27% do not require employees to change their passwords).

Business representatives were asked whether they had in place a series of mechanisms related to privacy practices. Four of the six privacy-related practices are used by half or more of surveyed businesses. This includes having a designated privacy officer (58%), having internal policies for staff that address privacy obligations (51%), having procedures for dealing with customer complaints (51%), and having procedures for responding to customer requests related to their personal information (50%). Fewer than half (45%) have a privacy policy that explains to customers how they collect/use customer personal information, while one-third regularly provide privacy training and education to staff.

Privacy as Corporate Objective

Most executives said their company attributes significant importance to privacy protection. More than half (59%) offered the highest score available (on a 7-point scale), indicating their belief that protecting their customers’ personal information is an extremely important corporate objective. In total, 82% offered positive scores on the scale, indicating that this is an important objective. At the other end of the spectrum, only 7% indicated clearly that protecting customers’ personal information was not an important objective for their firm.

Widespread confidence was expressed by business representatives in their firm’s ability to fully protect the personal information they collect about their customers. More than two-thirds (69%) said they were very confident, while almost all of the rest (28%) expressed moderate confidence in this.

Awareness and Impact of Privacy Laws

Business executives were asked to rate their company’s awareness of its responsibilities under Canada’s privacy laws, using a 7-point scale (1 = not at all aware, 7 = extremely aware). Almost half (45%) think their firm is extremely aware of its responsibilities. In total, almost two-thirds (66%) offered positive scores above the mid-point on the scale, indicating a relatively high level of familiarity with their privacy responsibilities. At the other end of the spectrum, 20% offered scores below the mid-point of the scale, suggesting a relatively low level of awareness. Over time, companies’ awareness of their responsibilities under Canada’s privacy laws has been fairly stable since 2007 when tracking began.

Executives were also asked to rate their level of awareness of the Personal Information Protection and Electronics Document Act (PIPEDA), the federal private-sector privacy law, using the same 7-point scale. In this case, just over one-third (35%) were extremely aware of the legislation. In total, over half (57%) offered positive scores above the mid-point on the scale, once again indicating a relatively high level of familiarity with their responsibilities. However, 28% offered scores below the mid-point of the scale, suggesting that a significant portion of businesses still have a relatively low level of awareness of PIPEDA.

Compliance

Business executives were asked how difficult it has been for their company to bring their personal information handling practices into compliance with Canada’s privacy laws (using a 7-point scale: 1 = extremely easy, 7 = extremely difficult). The largest proportion (41%) were neutral, viewing this as neither easy nor difficult. Most of the rest (38%) rated compliance with Canada’s privacy laws as easy, while 13% felt that this was difficult for their company. Over time, the perceived difficulty of bringing personal information handling practices into compliance with Canada’s privacy laws has increased modestly, while the perception that it is very easy has decreased somewhat.

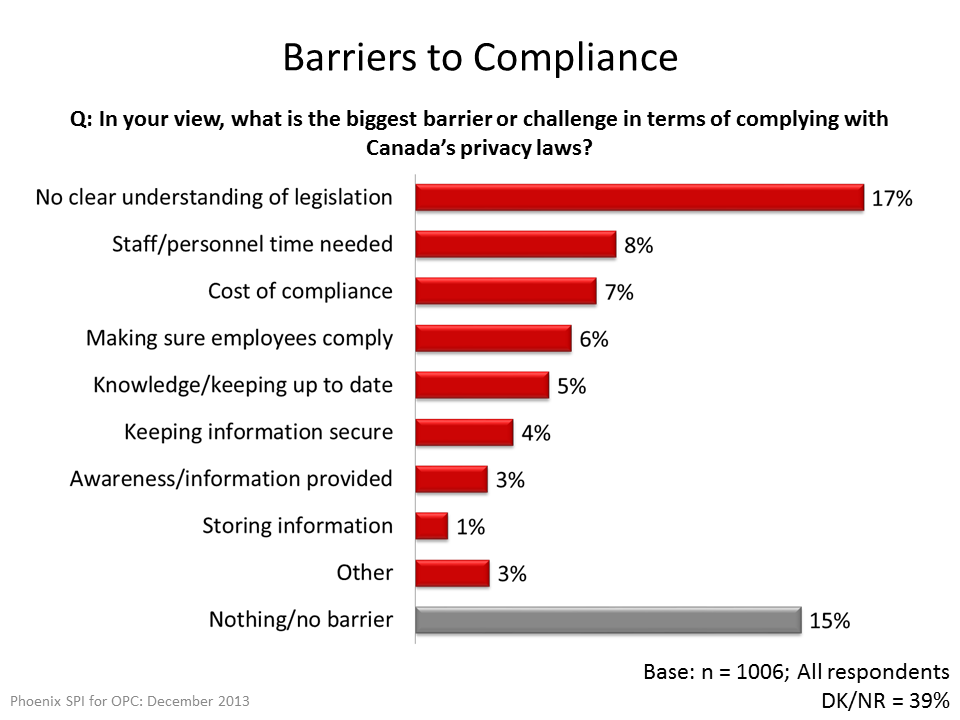

A lack of understanding of privacy legislation was identified most often (17%) as the most significant barrier or challenge in terms of complying with Canada’s privacy laws. Eight percent or less cited a number of other barriers: staff/personnel time needed (8%), cost of compliance (other than staff) (7%), making sure employees comply (6%), the need to keep their knowledge up to date (5%), and keeping the information secure (4%). Fully 39% did not offer a response.

Breaches

Surveyed executives were asked to rate their level of concern about a data breach, where the personal information of their customers is compromised (using a 7-point scale: 1 = not at all concerned; 7 = extremely concerned). Exactly half said they were not at all concerned about a data breach, while 24% said they were extremely concerned. In total, one-third offered scores above the mid-point of the scale, suggesting moderate concern about a data breach. Over time, Canadian businesses have become modestly less concerned about a data breach.

Executives were asked to identify what they think represents the greatest threat of a data breach occurring at their company. Heading the list were hacking (24%) and theft (19%). In addition, 11% identified employee error. A number of other potential threats were identified in small numbers (3% or less). Five percent of executives said they could think of no threats, while 25% did not provide a response.

Fifty eight percent of surveyed companies do not have guidelines in place in the event of a breach where the personal information of their customers is compromised and 5% were unsure. Conversely, 37% do have guidelines in place. The vast majority (95%) of businesses say they have never experienced a breach where the personal information of their customers was compromised. The proportion of companies who have guidelines in place to respond to a breach has increased modestly since 2011 (31%) and 2010 (34%)Footnote 1. The number of companies (4%) who say they have actually experienced a data breach has remained virtually unchanged since 2011 and 2010 (3% each).

Representatives of companies that have experienced a breach were asked what steps their company took to address the situation. The most common response was notifying individuals who were affected (40%), followed by resolving the issue with the individual responsible for the breach (29%) and enhancing their security system (28%). As well, some companies issued training to their staff (18%), reviewed their privacy policy (18%), notified law enforcement (17%), notified the relevant government agencies (6%), took legal action (2%), obtained information from the government (1%), or notified relevant departments within the company (1%). Eight percent of companies pursued other means of addressing with the breach.

Corporate Innovation

When asked whether their companies have policies in place to assess privacy risks related to their business, two-thirds (67%) said they do not, while 5% were uncertain.

Only 13% of surveyed businesses send customer’s personal data to a third party for processing, storage or other services. Of this 13%, two-thirds (68%) claimed to be aware that when a company transfers personal information to a third party for processing, storage or other services, which can include the use of cloud computing, it remains accountable for that information. Conversely, 31% were not aware of this accountability.

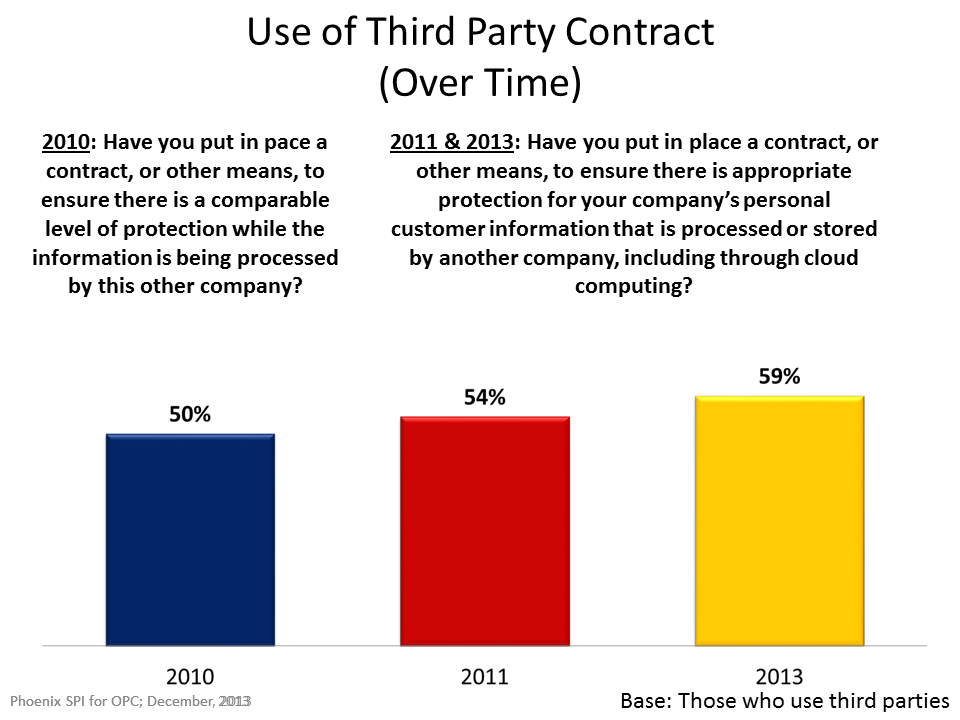

In 2013, a larger proportion (13%) of companies used third parties for handling their customers’ personal information than in 2011 (9%), however the proportion is still less than in 2010 (18%).Footnote 2 The number of companies with contracts in place to ensure their customers’ information is protected by the third party has increased over time (59% vs. 54% in 2011 and 50% in 2010).

Business representatives were asked about their company’s policy on allowing employees to use their personal electronic devices, such as smartphones, tablets or laptops, for work purposes. Approximately one in five (21%) companies allow employees to use their own devices for work. Of this 21%, two in three (64%) have not developed formal, internal policies to manage security issues related to employees using their own devices.

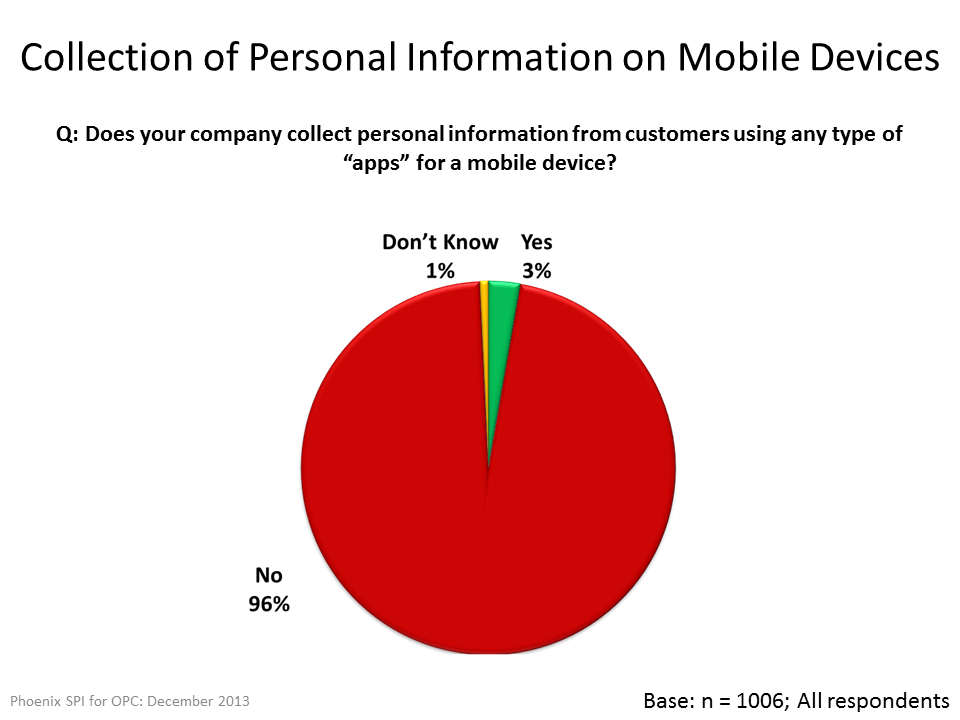

At this time, the vast majority of companies (96%) do not collect customers’ personal information using apps on mobile devices, with only 3% of business representatives stating that their company does collect such data.

Disclosures to Law Enforcement

Only a small number of companies (4%) say they have received requests from law enforcement representatives without a warrant for personal information in the last 2-3 years. Of those who have received such requests, 3% received a request between one and five times, and 1% received six requests or more. Approximately half (48%) of the companies who received the requests provided the information each time it was requested, while 40% never provided the information, and 13% provided the personal information “some of the time.”

Seeking Clarification About Responsibilities Under the Law

Most business representatives (86%) said their company has never sought clarification of its responsibilities under privacy laws in Canada. Approximately one in 10 companies have sought clarification.

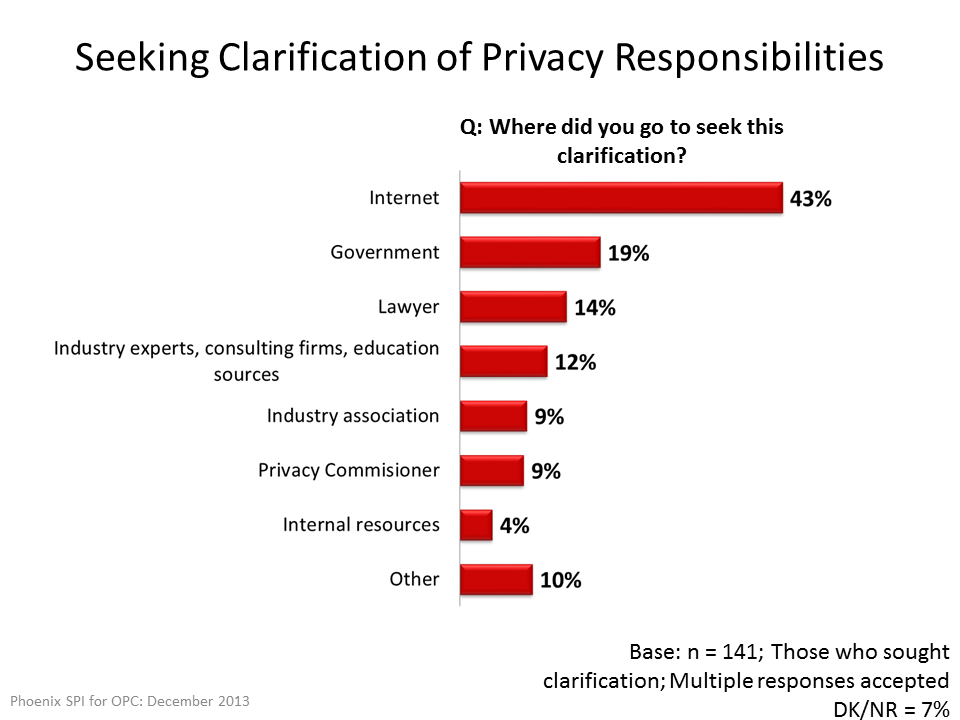

For companies that have sought clarification, the Internet (43%) was the main information source. Following this, 19% have gone to government agencies (federal, provincial, or general), 14% have sought the advice of a lawyer, 12% consulted industry experts, consulting firms or education source, 9% asked an industry association, 9% contacted the privacy commissioner, and 4% used their company’s internal resources.

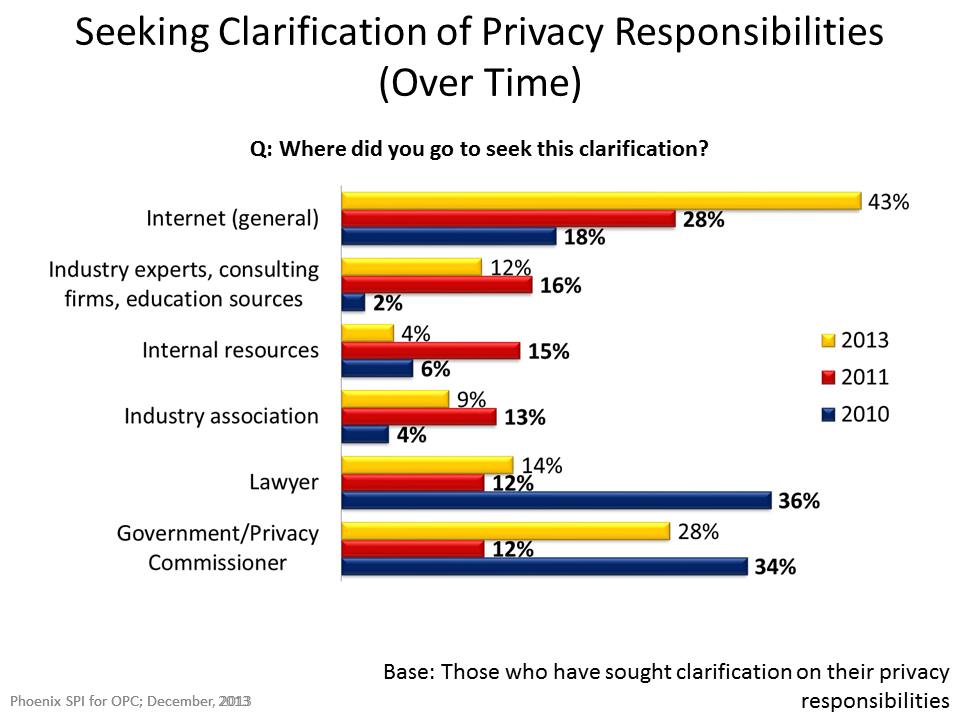

The proportion of companies (11%) that sought clarification on their responsibilities under Canada’s privacy laws in 2013 is lower than in 2011 (13%), 2007 (22%) and 2010 (22%). Where executives go for clarification on privacy laws has changed substantially since tracking began in 2010. More executives (43%) now turn to the Internet for clarification than in 2011 (28%) and 2010 (18%); more also turn to industry experts, consulting firms and education sources (12% vs. 2% in 2010, but 16% in 2011).

Office of the Privacy Commissioner of Canada

Forty-one percent of surveyed executives said they were aware that the Office of the Privacy Commissioner of Canada has information and tools available to companies to help them comply with their privacy obligations.

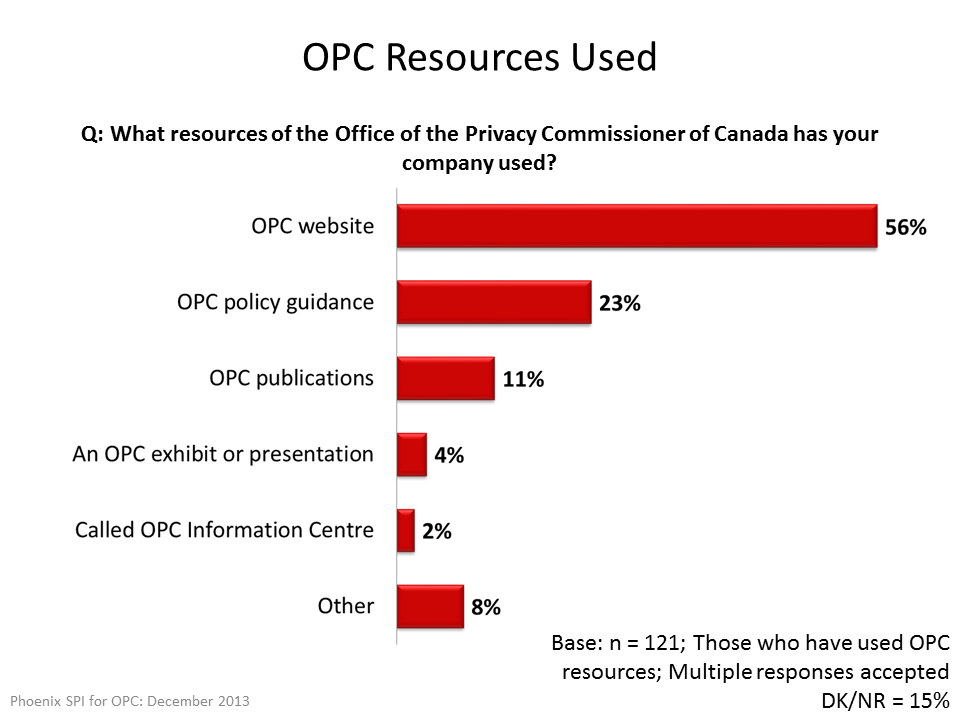

Of executives who were aware of OPC resources, the majority (78%) report that they have never used them. Fewer than one in five (17%) report that they have used OPC resources, although 5% were uncertain. Among companies that have used OPC resources to comply with their privacy obligations, the OPC website (56%) was the main source of reference. As well, 23% used OPC policy guidance, 11% OPC publications, 4% an OPC exhibit or presentation, and 2% called the OPC Information Centre.

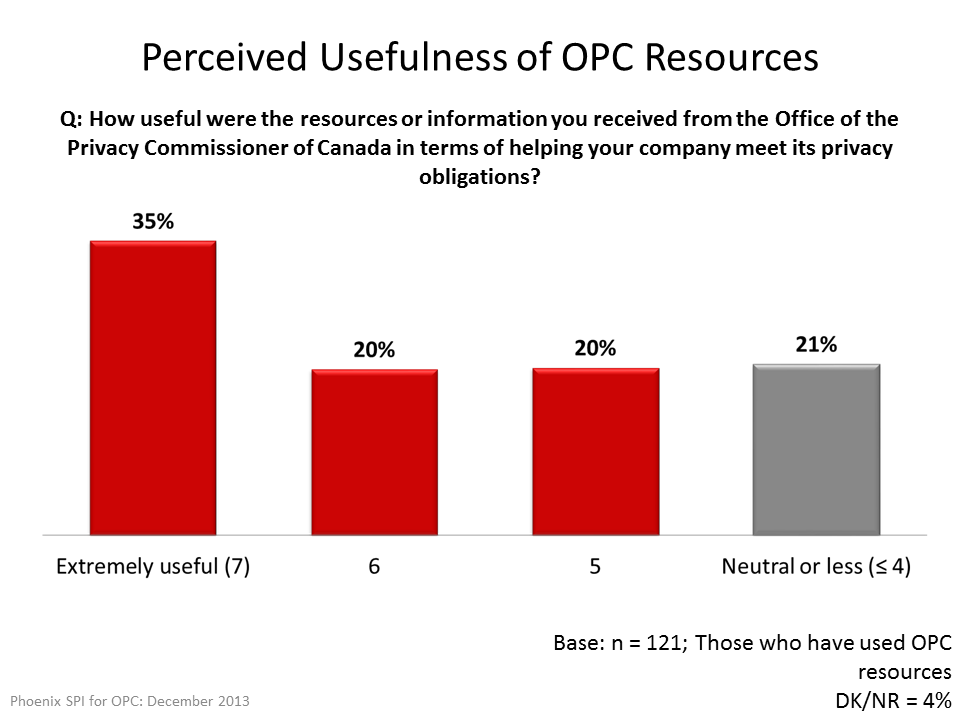

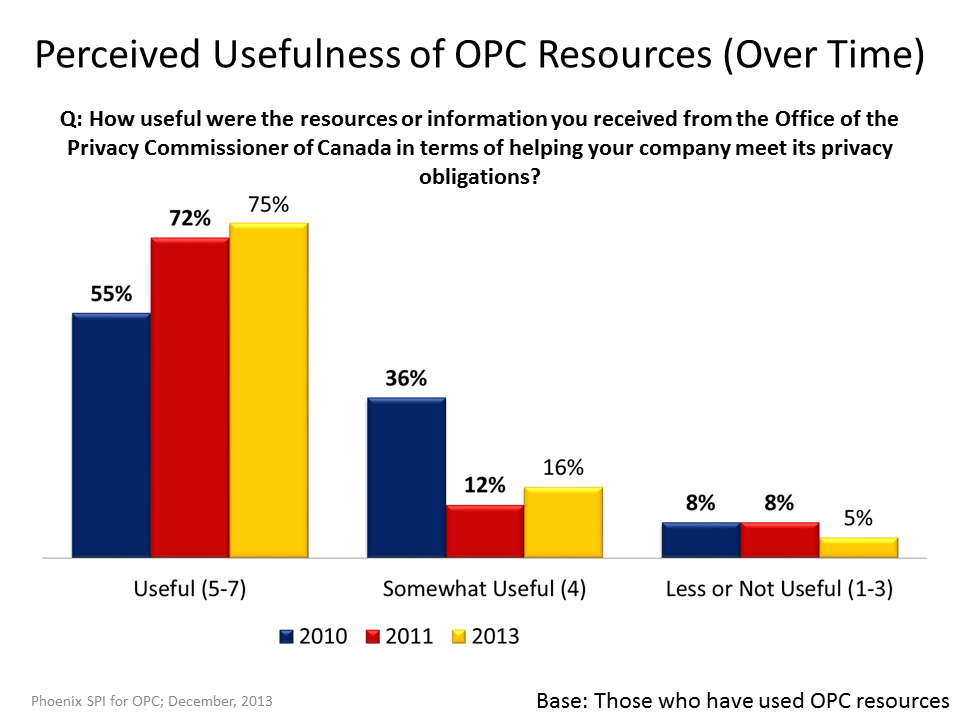

Executives were asked to rate the usefulness of privacy-related resources they received from the OPC (using a seven-point scale: 7 = extremely useful, 1 = not at all useful). Seventy-five percent rated their usefulness above the midpoint of the scale, with 35% stating that they were extremely useful. However, 21% reported their usefulness as neutral or lower. Five respondents offered low assessments of the usefulness of OPC resources (scores of 1-3) were asked why they found the resources or information not very useful. Reasons included that they already knew the information or that the information was not appropriate for their business size.

The perceived usefulness of OPC resources has increased since tracking began in 2010. Now, 75% feel OPC resources are useful (5 -7 on a 7-point scale), versus 72% in 2011 and 55% in 2010.

Privacy-Related Subgroup Differences

Firm size is the most apparent predictor of a company’s attitudes toward privacy and the number of mechanisms they currently have in place to protect privacy. Larger companies (with at least 100 employees) are more likely to practice a variety of methods of protecting customers’ information, to require employees to change their passwords routinely, to have designated representatives for privacy-related issues, and to have developed internal policies to address their privacy obligations. Larger companies are also more likely to place a higher amount of importance on protecting privacy, to have sought clarification of their responsibilities under privacy laws, and to have a higher awareness of PIPEDA. Companies with more employees are also more likely to seek clarification of their responsibilities under privacy laws.

When looking at the data by region, companies that are based in Quebec often provided responses that differed somewhat from businesses in the rest of Canada. For example, Quebec businesses are generally less likely to have procedures and mechanisms to protect personal information. Quebec-based businesses are also less likely to have appointed someone responsible for privacy issues and to have internal policies that address their privacy obligations. However, Quebec-based businesses are also least likely to collect customer information for providing services.

Introduction

Phoenix Strategic Perspectives Inc. (Phoenix) was commissioned by the Office of the Privacy Commissioner of Canada (OPC) to conduct quantitative research with Canadian businesses on privacy-related issues.

Background and Objectives

The OPC is an advocate for the privacy rights of Canadians with the powers to investigate complaints and conduct audits under two federal laws, publish information about personal information-handling practices in the public and private sectors, and conduct research into privacy issues. As part of this mandate, the OPC is responsible for overseeing compliance with the Personal Information Protection and Electronic Documents Act (PIPEDA), which applies to commercial activities in the Atlantic provinces, Ontario, Manitoba, Saskatchewan and the Territories. Quebec, Alberta and British Columbia each has its own law covering the private sector. Even in these provinces, PIPEDA continues to apply to the federally-regulated private sector and to personal information in interprovincial and international transactions.

Given the OPC’s mandate to protect and promote privacy rights, and ultimately to provide guidance to individuals and organizations on privacy issues, it needs to understand:

- The extent to which Canadian businesses are familiar with privacy issues and requirements.

- The type of privacy policies and practices these businesses have in place.

- Businesses’ understanding of Canada’s privacy laws and their privacy responsibilities.

- Businesses’ awareness of and responses to emerging privacy issues and practices.

The OPC seeks to understand these issues in the context of trends over time, through the tracking of key benchmarking questions. This research addresses these objectives and will be used to guide the OPC’s approach to fulfilling its mandate with respect to Canadian businesses.

Research Design

To meet the research objectives, a telephone survey was administered to 1,006 businesses across Canada.

The following specifications applied to the survey:

- The target respondent was a senior decision maker with responsibility and knowledge of their company’s privacy and security practices.

- A stratified random sampling approach was used for the data collection. The sampling frame was purchased from Dun & Bradstreet (D&B). A random sample frame was generated based on a sample-to-completion ratio of 10:1 for each of the three target business size quotas: small (1-19 employees); medium (20-99 employees; and large (100+ employees). The sample frame was generated in proportion to business population by region within each of the three business size groups.

- A detailed interviewer briefing note was prepared by Phoenix (and approved by the OPC) to brief interviewers and guide the data collection process.

- A telephone pre-test was conducted in English and French, with 10 interviews in each official language. Interviews were digitally recorded for review afterwards.

- Upon completion of the pre-test, Phoenix listened to the interviews and reviewed the resulting data. The data collected during the pre-test was not included in the final survey dataset because changes were made to the questionnaire as a result.

- Interviews averaged 15 minutes and were conducted in the respondent’s official language of choice.

- Calling was conducted at different times of the day and the week to maximize the opportunity to establish contact.

- Up to 10 call-backs were attempted to reach potential respondents before a sample record was retired.

- The sample was carefully monitored throughout the data collection period to ensure effective sample management to keep the study on target and maximize response rates.

- The survey was registered with Marketing Research and Intelligence Association’s (MRIA) national survey registration system.

- Sponsorship of the study was revealed (i.e. OPC).

- Data collection was conducted November 7-27, 2013.

- The following list presents information about the final call dispositions for this survey, as well as the associated response rate (using the MRIA formula)Footnote 3:

Call Disposition

- Total Numbers Attempted: 10,709

- Out-of-scope - Invalid: 1,124

- Unresolved (U): 4,466

- No answer/Answering machine: 4,466

- In-scope - Non-responding (IS): 1,623

- Language barrier: 63

- Incapable of completing (ill/deceased): 11

- Callback (Respondent not available): 1,549

- Total Asked: 3,496

- Refusal: 2,293

- Termination: 50

- In-scope - Responding units (R): 1,153

- Completed Interview: 1,006

- NQ - Quota Full - Company Size: 114

- NQ - Q1 (NOT FOR PROFIT/DK/REF): 33

- Response Rate: 15.9

All work performed adhered to or surpassed industry standards as determined by the MRIA, the industry association for survey research, as well as applicable federal legislation (PIPEDA). In addition, all work was performed in accordance with the Standards for the Conduct of Government of Canada Public Opinion Research – Telephone Surveys.

Analysis

Weights were applied to the final data to adjust for the sample design. Data was weighted to the national proportion of businesses to ensure representation by size, region and industry. Canadian statistics for the number of businesses by size, region and industry were obtained through the Business Register produced by Statistics Canada.

The weighting scheme was based on three variables: business size, region and industry. The Statistics Canada “Indeterminate” category of businesses was excluded from the business size distributions used to weight the survey data.

Three sets of weights were created for each of: 1) the overall results, 2) the regional results, and 3) the results by business size. The details are as follows:

- For the overall weight, results were first weighted by business size in each region. Three size breaks (1-9 employees, 20-99 employees and 100+ employees) and seven regions (British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Atlantic provinces) were used. They were then weighted by industry on a national level using the North American Classification System (NAICS).

- For the regional results, a second weight was developed based on region (Newfoundland and Labrador, New Brunswick, Nova Scotia and Prince Edward Island, Quebec, Ontario, Manitoba, Saskatchewan, Alberta and British Columbia) and industry (again using the NAICS). As with the overall weight, the regional results were weighted at the national level only by industry.

- For the results by business size, a third weight was developed based on business size (1-9 employees, 20-99 employees and 100+ employees). As with the overall and regional weights, the results by business size were weighted at the national level only by industry using the NAICS.

Notes to Readers

- Reference is made to findings from similar surveys conducted for the OPC with Canadian businesses in 2007, 2010 and 2011. Since weighting procedures and, in some cases, question wording differs among the surveys, comparisons over time should be interpreted with caution.

- All results in the report are expressed as a percentage, unless otherwise noted.

- Throughout the report, percentages may not always add to 100 due to rounding.

- Demographic and other subgroup differences are identified in the report. The text describing these differences throughout the report is put in a box and titled as: "Subgroup Variations" for easy identification. Only subgroup differences that are statistically significant at the 95% confidence level or are part of pattern or trend are reported. The table on the next page details how characteristics have been grouped for the analysis.

- Appended to the report are copies of the questionnaire in English and French.

Table 1: Subgroup Categories

Demographic Categories

Core IndustriesFootnote 4:

- Accommodation and Food Services

- Administrative & Support, Waste Management and Remediation Services

- Arts, Entertainment and Recreation

- Educational Services

- Finance and Insurance*

- Health Care and Social Assistance

- Information and Cultural Industries

- Professional, Scientific, Technical Services

- Public Administration

- Real Estate and Rental and Leasing

- Retail Trade

- Transportation and Warehousing

- Utilities

Non-Core Industries:

- Agriculture, Forestry, Fishing and Hunting

- Construction

- Management of Companies, Enterprises

- Manufacturing

- Mining and Oil and Gas Extraction

- Other Services (except Public Admin.)

- Wholesale Trade

- Other

Revenues

- Less than $1,000,000

- $1,000,000 to just under $10,000,000

- $10,000,000 to just under $20,000,000

- More than $20 million

Region:

- Quebec

- Atlantic Canada

- Alberta

- British Columbia (and the Yukon)

- Greater Toronto Area (GTA)

- Ontario (including GTA)

- The Prairies (SK,MB) and NT, NU

Company Business Model

- Sells directly to consumers

- Sells directly to other businesses/organizations

- Sells directly to both consumers and other businesses/organizations

Company Location:

- Operates at this location only

- Other locations, but only in province

- Locations in other provinces, but only in Canada

- Other locations, including outside Canada

Business size:

- Self-employed (1 employee)

- 2-19 employees

- 20-99

- 100 or more employees

Attitudinal Categories

Perceived Importance of Protecting Privacy

- Unimportant (1-3)

- Neither (4)

- Important (5-7)

Awareness of Privacy Obligations

- Unaware (1-3)

- Neither (4)

- Aware (5-7)

Perceived Difficulty of Compliance:

- Easy (1-3)

- Neither (4)

- Difficult (5-7)

Concern Over Data Breach

- Unconcerned (1-3)

- Neither (4)

- Concerned (5-7)

Collection and Storage of Personal Information

This section identifies privacy-related practices adopted by businesses to protect customers’ personal information. This includes the type of customers a business has, the type of information collected, how it is used, and the procedures and policies in place to protect this information.

Different Company Types in Terms of Customers Served

Surveyed business representatives work for a mix of different companies in terms of the type of customers served. In total, 36% of these companies sell directly to consumers (i.e., members of the general public or some subset of it). Almost as many (35%) sell both to the general public and to other businesses/organizations. Approximately one-quarter (26%) sell only to other businesses/organizations, while 2% provide services that do not fall into any of these categories.

Text version

Figure 1: Company Type

Q: Which of the following best describes your company?

| Type of Company | % |

|---|---|

| Sells directly to consumers | 36% |

| Sells directly both to consumers and other businesses/organizations | 35% |

| Sells directly to other businesses/organizations | 26% |

| Other | 2% |

Base: n = 1006; All respondents

Don’t know/No Response= <1%

Contact, Location Information—Types of Information Widely Collected

In terms of the types of information collected about customers, virtually all of the surveyed companies (97%) collect contact information, such as names, phone numbers, and addresses. The large majority (83%) collect location information, such as postal codes. Other types of information mentioned with some frequency include opinions, evaluations, and comments (27%), financial information, such as invoices, credit cards, or banking records (25%), purchasing habits (18%), and medical information (13%). Two percent said they collect customer email addresses (undoubtedly others do also, but that is included in the ‘contact information’ category).

Information included in the ‘other’ category are birthdays, credit information, a Social Insurance Number, and a Driver’s License number. In total, 1% said they do not collect any of these types of customer information.

Text version

Figure 2: Types of Information Collected

Q: Which of the following types of information does your company collect about your customers?

| Types of Information Collected | % |

|---|---|

| Contact information, such as names, phone numbers, and addresses | 97% |

| Location information, such as postal codes | 83% |

| Opinions, evaluations, and comments | 27% |

| Financial | 25% |

| Purchasing habits | 18% |

| Medical information | 13% |

| Email address | 2% |

| Birthday | 1% |

| Credit Information | 1% |

| Social Insurance Number | 1% |

| Driver's License | 0% |

| Other information | 4% |

| None of the above | 1% |

Base: n = 1006; All respondents

Multiple responses accepted; Don’t know/No Response= <1%

In terms of diversity of information collected, most companies (65%) collect either two (39%) or three (26%) different categories of information mentioned above. Nearly a quarter (24%) collect more than that, while 11% collect less.

Subgroup Variations

The following subgroup differences were evident:

- Companies that sell only to consumers were generally less likely to collect customer data than companies that sell to businesses and companies that sell to both other businesses and consumers. For example, fewer companies that sell only to consumers collect location information (76%), financial information (19%), and information on purchasing habits (13%).

- Compared to smaller companies, larger ones generally collect more customer information. Companies with 100 employees or more (43%) are more likely to collect financial information than smaller companies: 37% of those with 20–99 employees, 24% of firms with 2–19 employees, and 14% of self-employed individuals. Larger companies are also more likely to collect the following information:

- Customers’ opinions, evaluations and comments (54%)

- Customers’ purchasing habits (29%)

- Location information (90%)

- Medical information (17%).

- Members of core industries are more likely than members in non-core industries to collect medical information (18% vs. 8% in non-core industries) and financial information (28% vs. 20% in non-core industries).

- Representatives of companies that attribute high importance to protecting privacy were more likely to report that their firm collects customers’ opinions, evaluations and comments (30% vs. 6% of representatives that are neutral when it comes to protecting privacy and 12% of those that perceive it as unimportant), financial information (27% vs. 25% and 8% respectively) and medical information (16% vs. 1% and 3% respectively).

- Representatives of companies with high awareness of their privacy obligations are most likely to work at a business that collects medical information from customers (18% vs. 6% of companies rated neutral on their awareness of their privacy obligations and 3% of companies reported to be unaware).

- Representatives who said their companies have had a hard time complying with Canada’s privacy laws are most likely to work for firms that collect customers’ opinions, evaluations and comments (37% vs. 26% of those who said it was neither difficult nor easy and 24% of those who saying it has been difficult).

Providing Service—Most Common Use of Customer Information

Approximately two-thirds (68%) of Canadian businesses use customers’ personal information to help provide service to those customers. Slightly less than one-third (31%) use it to build customer profiles. Other uses mentioned with some frequency are marketing (17%) and use for financial matters, such as accounting, billing and invoicing (14%). Only 3% identified using customer information for communications or contact purposes.

Text version

Figure 3: Company Use of Customer Information

Q: What does your business do with the personal information that it collects about your customers?

| Company Use | % |

|---|---|

| Providing service | 68% |

| Building customer profiles to personalize service | 31% |

| Marketing | 17% |

| For accounting/ billing/ invoicing purposes | 14% |

| For communication/contact purposes | 3% |

| Some other purpose | 5% |

Base: n = 1006; All respondents

Multiple responses accepted; Don’t know/No Response= 8%

Subgroup Variations

The following sub-group differences were evident:

- Quebec-based businesses (51%) are least likely to collect customer information for providing services, followed by Atlantic Canada (61%) vs. 73–80% of firms based elsewhere in Canada).

- Companies that sell only to consumers are least likely to use customer information for providing services and for accounting and billing purposes.

- Larger companies are more likely to use the customer data they collect for providing services (81% of those with 100+ employees vs. 70% or fewer of smaller companies) and building customer profiles to personalize services (41% of companies with 100+ employees vs. 28% of self-employed respondents).

- Businesses in non-core industries are more likely than core-industry businesses to use customer information for accounting and billing purposes (18% vs. 11% in core industries).

- Executives who are not concerned about a data breach are least likely to work for a company that uses customer information to build customer profiles to personalize their services (26% vs. 38% of those who are concerned and 43% of those who are neutral).

- Companies that have a privacy policy in place are more likely to use customer information for providing services (76% vs. 61% of companies with no official privacy policy) and for building customer profiles (36% vs. 27% of companies with no official privacy policy). Accordingly, representatives of companies without a privacy policy were more likely to choose “don’t know/no response” with respect to how their company uses customer information.

Variety of Methods Used to Store Personal Information

Three methods are commonly used by Canadian businesses to store personal information about their customers, each identified by a clear majority of business representatives. These include paper records stored on site (62%), the use of on-site servers (58%), and the use of desktop computers (55%). No other methods came close.

Nearly one quarter (24%) use portable devices, such as laptops, USB sticks, or tablets, while smaller numbers use cloud computing (7%) and a third party (excluding cloud computing) (7%).

Just over two-thirds (68%) of Canadian businesses use more than one method of storing the personal information they collect on their customers. Equal proportions (32%) of businesses use either one or two methods of storing customers’ information. Slightly more than one-third (36%) use three methods or more.

Text version

Figure 4: Methods of Storing Personal Information

Q: In which of the following ways does your company store personal information on your customers?

| Methods of Storing | % |

|---|---|

| Stored on-site on paper | 62% |

| Stored on-site on servers | 58% |

| Stored on desktop computers | 55% |

| Stored on portable devices, such as laptops, USB sticks, or tablets | 24% |

| Stored through a third party, not including cloud computing | 7% |

| Stored electronically through cloud computing | 7% |

| Stored by video and audio recordings | 1% |

| Stored in some other way | 1% |

Base: n = 1006; All respondents

Don’t know/No Response= 3%

Subgroup Variations

The following subgroup differences were evident:

- With respect to whether a company sells to consumers, businesses or both, companies that sell only to consumers are least likely to store customers’ personal information on on-site servers (48% vs. 61 – 65% of other companies) and desktop computers (45% vs. 59 – 63% of other companies). Companies that sell only to businesses are more likely than other company types to store customer data on portable devices (32% vs. 18% and 23% of other companies).

- The likelihood of storing customer data on on-site servers increases with the size of the company. The largest companies (100+ employees) are also more likely to store customer data electronically through cloud computing. Smaller companies are more likely to store customer data on desktop computers.

- Companies in core industries are more likely to store customer data on on-site servers (61% vs. 53% of companies in non-core industries) and with a third party—excluding cloud computing—(10% vs. 3% for non-core industries).

- Companies that place a high degree of importance on protecting privacy are more likely to store customer data on on-site servers (60% vs. 53% of companies that perceive privacy as neither important nor unimportant and 44% that who view it as unimportant).

- Businesses that have a high awareness of their privacy obligations are more likely to store customer data on on-site servers than businesses with less awareness (62% vs. 53% of businesses neither aware nor unaware of their privacy obligations and 46% of those unaware).

Personal Information Protection Practices

Minority Use Encryption on Portable Devices

Business executives whose firms use portable devices, such as laptops, USB sticks, or tablets, to store their customers’ personal information were asked whether or not their company uses encryption to protect information stored in this way. In response, 36% said that they did, whereas 58% said they did not. Six percent were uncertain.

Text version

Figure 5: Use of Encryption on Portable Devices

Q: Does your company use encryption to protect the personal information you store on portable devices, such as laptops, USB sticks, or tablets?

| Use of Encryption | % |

|---|---|

| Yes | 36% |

| No | 58% |

| Not sure | 6% |

Base: n = 224; those who use portable devices

Due to rounding, numbers may not sum to 100%

Compared to 2011, the number of businesses that store personal information on portable devices is virtually unchanged but the reported use of encryption on portable devices has decreased slightly: 36% vs. 44% in 2011.

Subgroup Variations

The likelihood of using encryption was highest amongst companies that place a high degree of importance on protecting privacy (42% vs. 5% to 20% of companies that place lower degrees of importance on this) and companies that have a higher awareness of privacy obligations (49% vs. 11% to 19% of companies with lower awareness).

Technological Tools, Physical Measures—Main Ways of Protecting Customer Information

Canadian businesses use a number of methods to protect the personal information of their customers. More that three-quarters use technological tools, such as passwords, encryption, or firewalls (78%), or physical measures, such as locked filing cabinets, restricting access, or security alarms (78%). Almost two-thirds (65%) use organizational controls, such as policies and procedures.

Seven percent said they take no measures.

Looked at somewhat differently, 77% of Canadian businesses use more than one method to protect the personal information of their customers. Conversely, 23% use only one.

Text version

Figure 6: Methods Used to Protect Customer Information

Q: What steps do you take to protect the personal information on your customers?

| Methods | % |

|---|---|

| Technological tools, such as passwords, encryption, or firewalls. | 78% |

| Physical measures, such as locked filing cabinets, restricting access, or security alarms. | 78% |

| Organizational controls, such as policies and procedures. | 65% |

| No measures taken | 7% |

Base: n = 1006; All respondents

Multiple responses accepted; Don’t know/No Response= 1%

Subgroup Variations

The following subgroup differences were evident:

- Companies in the Prairies are most likely (80%) to have policies and procedures (organizational controls) in place to protect customers’ personal information, whereas Quebec-based companies (41%) are the least likely to have organizational controls in place.

- Companies that sell only to consumers are the least likely to use technological tools (66%) and specific organization controls (56%) to protect their customers’ personal information. Businesses that sell to customers and businesses are the most likely to use physical measures such as locks and security alarms (84%).

- Larger companies are generally more likely to implement a variety of measures to protect their customers’ information. Correspondingly, self-employed individuals are the most likely to have no measures in place to protect customers’ information (24% vs. 1% to 5% of companies with two or more employees).

- Companies that perceive protecting privacy as unimportant are the least likely to implement security measures, such as using physical locks or security alarms (54%) and having privacy-related policies and procedures in place (33%). Conversely, companies that place higher importance on protecting privacy are the most likely to have implemented technological tools, such as passwords, encryption or firewalls (83%).

- Companies for which executives indicated awareness of their privacy obligations are less likely to have implemented technological tools (67%), physical controls (65%), and organizational controls (50%).

Passwords, Firewalls—Most Common Tools Used to Protect Information

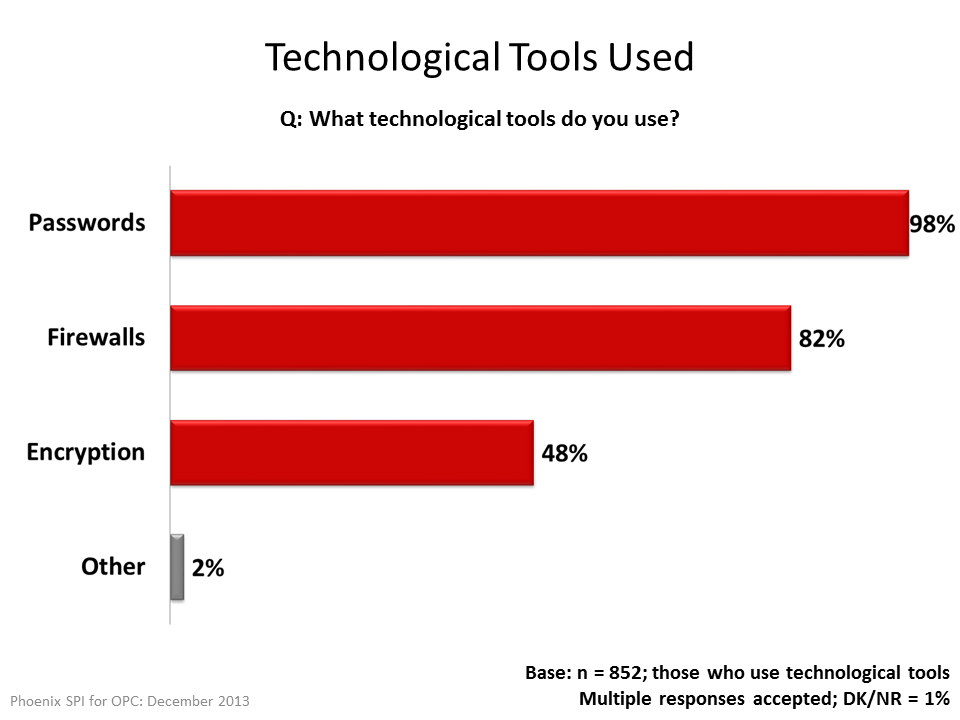

Of those that reported using technological tools to protect customer information, almost everyone (98%) uses passwords. As well, 82% use firewalls, while 48% use encryption.

Text version

Figure 7: Technological Tools Used

Q: What technological tools do you use?

| Technological Tools | % |

|---|---|

| Passwords | 98% |

| Firewalls | 82% |

| Encryption | 48% |

| Other | 2% |

Base: n = 852; those who use technological tools

Multiple responses accepted; Don’t know/No Response= 1%

Compared to 2011, use of these tools has increased slightly: passwords (98% vs. 96% in 2011), firewalls ( 82% vs. 79% in 2011), and encryption (48% vs. 43% in 2011).

Subgroup Variations

- The likelihood of using these technological tools was lowest among: companies in Quebec, self-employed individuals, and companies operating in non-core industries.

- Companies with 100 employees or more were the most likely to use all three tools.

- Businesses that reported they are highly aware of their privacy obligations were more likely to use all three tools.

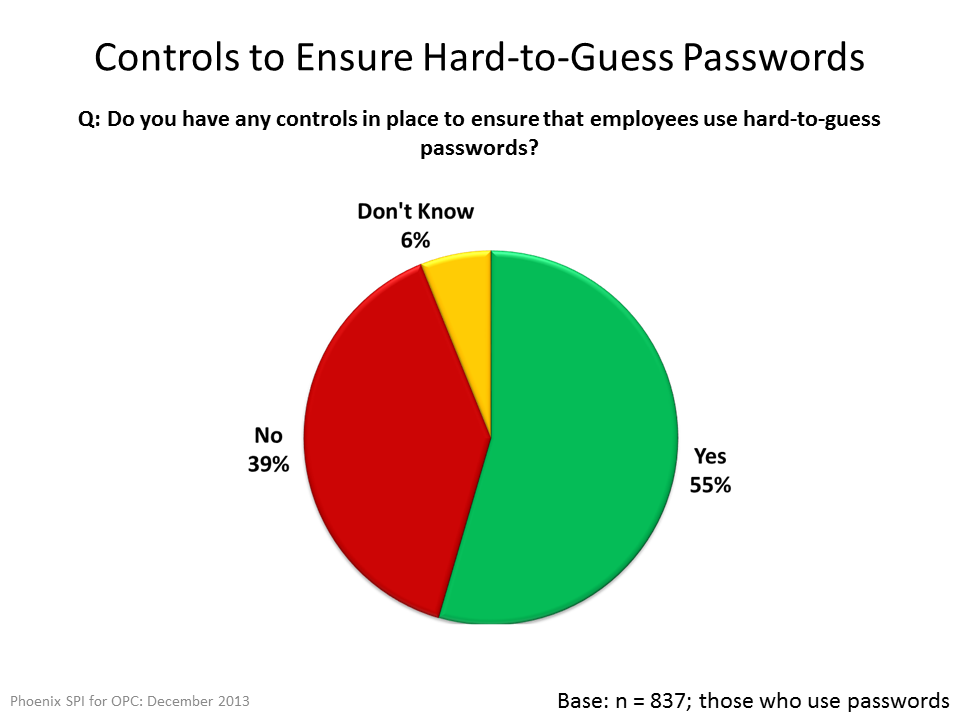

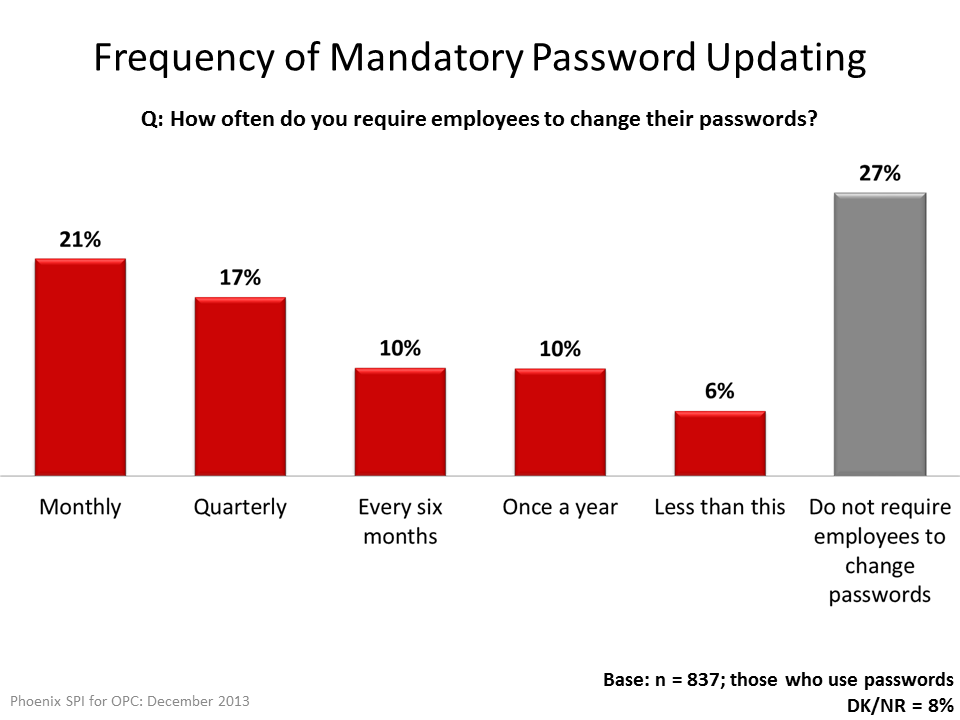

Of businesses that use passwords, 55% have controls in place to ensure that employees use hard-to-guess passwords (6% were uncertain). Also, most require their employees to change their passwords: 21% require this monthly, 17% quarterly, 10% every six months, 10% yearly, and 6% less frequently than yearly. Just over one-quarter (27%) do not require their employees to change their passwords. These findings are virtually unchanged since the 2011 survey.

Text version

Figure 8: Controls to Ensure Hard-to-Guess Passwords

Q: Do you have any controls in place to ensure that employees use hard-to-guess passwords?

| Controls | % |

|---|---|

| Yes | 55% |

| No | 39% |

| Don’t know | 6% |

Base: n = 837; those who use passwords

Text version

Figure 9: Frequency of Mandatory Password Updating

Q: How often do you require employees to change their passwords?

| Frequency | % |

|---|---|

| Monthly | 21% |

| Quarterly | 17% |

| Every six months | 10% |

| Once a year | 10% |

| Less than this | 6% |

| Do not require employees to change passwords | 27% |

Base: n = 837; those who use passwords

Don’t know/No Response= 8%

Subgroup Variations

- A positive relationship was seen between how frequently companies require their employees to update their passwords and their perception of protecting privacy as important, and awareness of their privacy obligations.

- Companies with 100 employees or more expressed the most diligence in requiring employees to change their passwords—they were more likely to require employees to change their passwords monthly (29%) and quarterly (34%). Accordingly, companies with fewer than 100 employees were more likely not to have mandatory password changes (23% to 32% vs. 11% of companies with 100+ employees).

- A positive relationship was seen between the likelihood that a company has controls in place to ensure hard-to-guess passwords and: the perception they hold of the importance of protecting privacy, their awareness of their privacy obligations, and the perception of how difficult it is to comply with privacy laws.

Mixed Experience in Terms of Privacy Practices in Place

Business representatives were asked whether they had in place a series of mechanisms related to privacy practices. These mechanisms included:

- Having designated someone in their company to be responsible for privacy issues and personal information that the company holds

- Having documented internal policies for staff that address their privacy obligations under the law

- Having staff regularly receive privacy training and education

- Having procedures in place for responding to customer requests for access to their personal information

- Having procedures in place for dealing with complaints from customers who feel that their information has been handled improperly

- Having a privacy policy that explains to customers how they will collect and use customer personal information.

Four of these privacy-related practices are used by half or more of surveyed businesses. This includes having a designated privacy officer (58%), having internal policies for staff that address privacy obligations (51%), having procedures for dealing with customer complaints (51%), and having procedures for responding to customer requests related to their personal information (50%).

Fewer than half (45%) have a privacy policy that explains to customers how they will collect and use customer personal information, while one-third (34%) regularly provide privacy training and education to staff.

Text version

Figure 10: Company Privacy Practices

| Question on privacy practices | % saying yes |

|---|---|

| Have designated privacy officer | 58% |

| Developed staff policies re: privacy | 51% |

| Have procedures for dealing with privacy complaints | 51% |

| Have procedures for customer requests for personal information | 50% |

| Have privacy policy | 45% |

| Provide staff training re: privacy | 33% |

Base: n = 1006; All respondents

Approximately two in three (70%) firms have adopted more than one of these mechanisms. Two in five (40%) have adopted four mechanisms or more, 14% of firms employ only one mechanism, and 16% have not adopted any.

| Number of mechanisms adopted | Percentage of firms | Percentage of firms with at least this many mechanisms adopted |

|---|---|---|

| None | 16% | n/a |

| 1 | 14% | 84% |

| 2 | 14% | 70% |

| 3 | 15% | 55% |

| 4 | 14% | 40% |

| 5 | 11% | 26% |

| 6 | 15% | 15% |

Subgroup Variations

The following subgroup differences were evident:

- There was a positive relationship between the likelihood of a company having designated someone to be responsible for privacy issues and the following: the number of employees, their perception of the importance of privacy, and their awareness of their privacy obligations. The likelihood of having someone responsible for privacy issues was highest among:

- Companies with 100 employees or more (72%)

- Companies in core industries (62%)

- Those who place a high importance on protecting privacy (64%)

- Those most aware of their privacy obligations (65%).

- There was a positive relationship between the likelihood of a company having developed internal policies that address their privacy obligations and the following: the number of employees, their perception of the importance of privacy, and their awareness of their privacy obligations. The likelihood of having documented policies was highest among:

- Companies with 100 employees or more (78%)

- Companies in core industries (56%)

- Those who place a high importance on protecting privacy (58%)

- Those with more awareness of their privacy obligations (63%).

- There was a positive relationship between the likelihood of a company providing their staff with privacy training and education and the following: the level of importance they place on protecting privacy, their awareness of their privacy obligations, and their concern over a data breach. The likelihood of providing training was highest among the following:

- Those who place a high amount of importance on privacy (39%)

- Those with higher awareness of their privacy responsibilities (45%)

- Those who are more concerned about a data breach (40%).

- The likelihood of having procedures in place for responding to customer requests for information was highest among the following:

- Companies that sell to consumers and businesses (57%)

- Companies in core industries (58%)

- Those that place a high importance on protecting privacy (57%)

- Those with higher awareness of their privacy obligations (57%).

- There was a positive relationship between the likelihood that a company has procedures in place for dealing with complaints from customers who feel that their information was handled improperly and the following: the number of employees, their perception of the importance of protecting privacy, their awareness of privacy guidelines, and their level of concern over a data breach. The likelihood of having procedures in place was highest among:

- Companies that sell to businesses and consumers (58%)

- Companies with 100 employees or more (61%)

- Companies in core industries (55%)

- Those that place a high amount of importance on protecting privacy (57%)

- Those with higher awareness of their privacy obligations (59%)

- Those with more concern about a data breach (55%).

- There was a positive relationship between the likelihood that a company has a privacy policy that explains to customers how they collect and use the information and the following: the number of employees, their perception of the importance of protecting privacy, and their awareness of their privacy obligations. The likelihood of having explanations for customers was highest among:

- Companies with 100 employees or more (51%)

- Companies in core industries (50%)

- Those that place a higher level of importance on protecting privacy (51%)

- Those with higher awareness of their privacy obligations (56%).

Companies in Quebec are generally less likely to have taken steps to improve their ability to privately manage customer information. For example, Quebec-based companies are less likely to have designated someone to be responsible for privacy issues and personal information (34% vs. 55% to 67% of firms in other regions) and to have a privacy policy that explains to customers how they collect and use their personal information (24% vs. 46% to 58% of firms in other regions).

Privacy as Corporate Objective

This section explores perceptions of privacy as a corporate objective, and confidence in their firm’s ability to protect customers’ personal information.

Most Attribute Significant Importance to Protecting Privacy

Most business executives said their company attributes significant importance to privacy protection. More than half (59%) offered the highest score available (on a 7-point scale), indicating their belief that protecting their customers’ personal information is an extremely important corporate objective. In total, 82% offered positive scores on the scale, indicating that this is an important objective. At the other end of the spectrum, 7% indicated clearly that protecting customers’ personal information was not an important objective at all for their company.

Text version

Figure 11: Perceived Importance of Protecting Privacy

Q: What importance does your company attribute to protecting privacy?

| Importance | % |

|---|---|

| Extremely important (7) | 59% |

| 6 | 11% |

| 5 | 12% |

| 4 | 5% |

| 3 | 3% |

| 2 | 2% |

| Not important at all (1) | 7% |

Base: n = 1006; All respondents

Don’t know/No Response= 1%

Subgroup Variations

The likelihood of placing a high amount of importance (6 or 7 on a 7-point scale) on protecting privacy was highest among:

- Companies that sell to consumers only (65%) or that sell to consumers and businesses (62%) vs. 44% of those that sell only to businesses

- Companies with 100 employees or more (67% vs. 55% and 59% of small- and medium-sized companies)

- Companies in core industries (65% vs. 50% of others)

- Those with a higher awareness of their privacy obligations (85% vs. 54% or fewer of companies with lower levels of awareness)

- Those with higher concerns over a data breach (70% vs. 52% to 58% of companies that are not concerned about a data breach).

Widespread Confidence in Firm’s Ability to Protect Information

There was widespread confidence expressed by business representatives in their firms’ ability to fully protect the personal information they collect about customers. More than two-thirds (69%) said they were very confident, while almost all of the rest (28%) expressed moderate confidence in this.

Text version

Figure 12: Confidence in Firm’s Ability to Protect Information

Q: How confident are you that your company knows how to fully protect the personal information you collect?

| Confidence | % |

|---|---|

| very confident | 69% |

| moderately confident | 28% |

| not very confident | 1% |

| not confident at all | 1% |

Base: n = 1006; All respondents

Don’t know/No Response= 1%

Subgroup Variations

The following subgroup differences were evident:

- Executives at companies that sell only to consumers were more confident in their company’s ability to protect customer information (73% vs. 61% of companies that sell to businesses and 68% of companies that sell to consumers and businesses).

- Confidence was higher among companies operating in core industries (72% vs. 65% of others).

- Those who perceived protecting privacy as important had more confidence in their firm’s ability to protect customers’ information (74% vs. 28% of companies that are neutral on protecting privacy and 53% of those that view it as unimportant).

- Those who perceive their company’s awareness of their privacy obligations as high had more confidence in its ability to protect customer information (77% vs. 61% or fewer of companies with lower reported levels of awareness)

- Those who perceived it to be easy to comply with privacy laws had more confidence in their company’s ability to protect customers’ information (79% vs. 66% or fewer of companies that do not find it easy)

Awareness and Impact of Privacy Laws

This section explores executives’ awareness of privacy laws in Canada. Questions in this section were prefaced with the following description of Canada’s privacy laws:

The federal government’s privacy law, the Personal Information and Protection and Electronic Documents Act or PIPEDA, sets out rules that govern how businesses engaged in commercial activities should protect personal information. In Alberta, BC and Quebec, the private sector is governed by provincial laws, which are considered to be similar to the federal law.

Increasing Awareness of Company’s Responsibilities Under Canada’s Privacy Laws

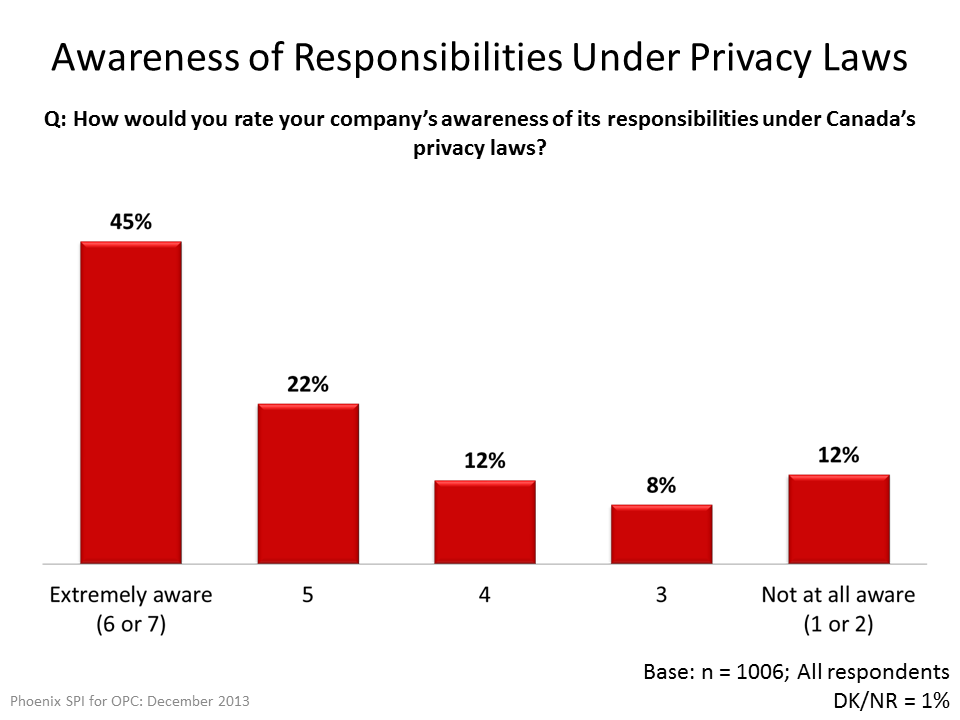

Business executives were asked to rate their company’s awareness of its responsibilities under Canada’s privacy laws, using a 7-point scale (1 = not at all aware, 7 = extremely aware). Almost half (45%) think their firm is extremely aware of its responsibilities, while an additional 22% claimed some level of awareness (score of 5). In total, two-thirds (67%) offered positive scores above the mid-point on the scale, indicating a relatively high level of familiarity with their privacy responsibilities.

Text version

Figure 13: Awareness of Responsibilities Under Privacy Laws

Q: How would you rate your company’s awareness of its responsibilities under Canada’s privacy laws?

| Awareness | % |

|---|---|

| Extremely aware (6 or 7) | 45% |

| 5 | 22% |

| 4 | 12% |

| 3 | 8% |

| Not at all aware (1 or 2) | 12% |

Base: n = 1006; All respondents

Don’t know/No Response= 1%

At the other end of the spectrum, 20% offered scores below the mid-point of the scale, suggesting a relatively low level of awareness.

Over time, companies’ awareness of their responsibilities under Canada’s privacy laws has been fairly stable. The proportion of companies with a high awareness of their privacy responsibilities has decreased only slightly, from 49% in 2007 to 45% in 2013. The percentage of companies with moderate awareness has remained unchanged at 42%, with just a single increase to 47% in 2011. In total, 12% express a low awareness of Canada’s privacy laws, down from 19% in 2011, and up from 8% in 2007 when tracking began.

Text version

Figure 14: Awareness of Responsibilities Under Privacy Laws (Over Time)

Q: How would you rate your company’s awareness of its responsibilities under Canada’s privacy laws?

| Awareness | 2007 | 2010 | 2011 | 2013 |

|---|---|---|---|---|

| High awareness (6-7) | 49% | 47% | 41% | 45% |

| Moderate awareness (3-5) | 42% | 42% | 47% | 42% |

| Low awareness (1-2) | 8% | 10% | 19% | 12% |

Base: All respondents

Subgroup Variations

The likelihood of reporting high (6-7) awareness of responsibilities under Canada’s privacy laws was highest amongst:

- Companies that sell only to consumers (49% vs. 44% of other companies that sell to consumers and businesses and 38% of companies selling only to businesses)

- Companies with 100 employees or more (65% vs. 41% and 46% of small- and medium-sized companies)

- Those who view protecting privacy as important (51% vs. 17% or fewer of companies that do not view protecting privacy as important)

- Those most concerned about a data breach (54% vs. 40% or fewer of representatives who are neutral or unconcerned).

More Limited Awareness of PIPEDA

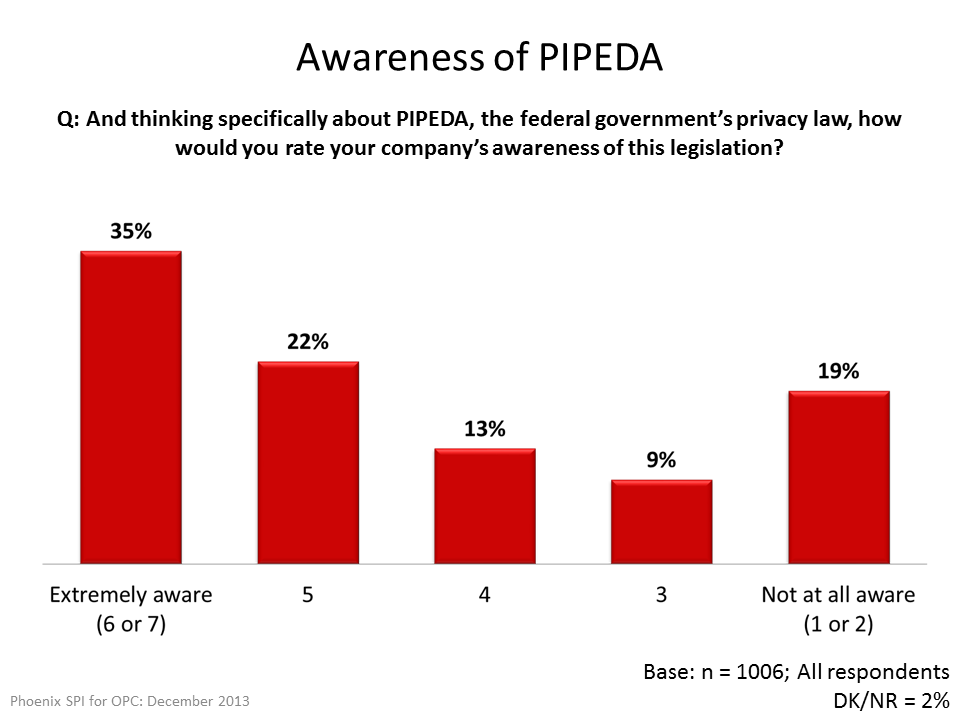

Executives were also asked to rate their level of awareness of PIPEDA using the same 7-point scale. In this case, just over one-third (35%) were extremely aware of the legislation, while 22% expressed some awareness (score of 5). In total, therefore, over half (57%) offered positive scores above the mid-point on the scale, once again indicating a relatively high level of familiarity with their responsibilities.

Text version

Figure 15: Awareness of PIPEDA

Q: And thinking specifically about PIPEDA, the federal government’s privacy law, how would you rate your company’s awareness of this legislation?

| Awareness | % |

|---|---|

| Extremely aware (6 or 7) | 35% |

| 5 | 22% |

| 4 | 13% |

| 3 | 9% |

| Not at all aware (1 or 2) | 19% |

Base: n = 1006; All respondents

Don’t know/No Response= 2%

However, 28% offered scores below the mid-point of the scale, suggesting a relatively low level of awareness. Awareness of PIPEDA specifically is therefore slightly lower than awareness of responsibilities under Canada’s privacy laws more generally.

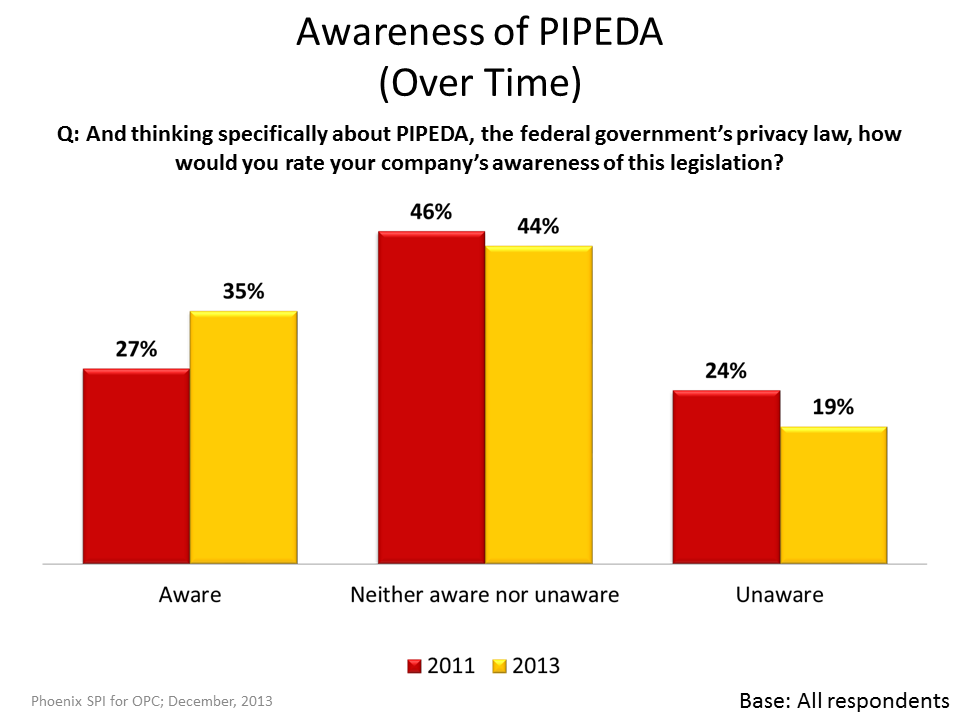

Businesses’ awareness of PIPEDA increased modestly, from 27% in 2011 to 35% in 2013. Accordingly, the number of executives reporting that their company is unaware of this legislation decreased slightly (from 24% in 2011 to 19% in 2013).

Text version

Figure 16: Awareness of PIPEDA (Over Time)

Q: And thinking specifically about PIPEDA, the federal government’s privacy law, how would you rate your company’s awareness of this legislation?

| Awareness | 2011 | 2013 |

|---|---|---|

| Aware | 27% | 35% |

| Neither aware nor unaware | 46% | 44% |

| Unaware | 24% | 19% |

Base: All respondents

Subgroup Variations

The likelihood of reporting their company’s awareness of responsibilities under Canada’s privacy laws as very high (6-7) was highest amongst:

- Companies with 100 employees or more (54%)

- Companies in core industries (38% vs. 30% for non-core industries)

- Those who perceive protecting privacy as important (40%)

- Representatives at companies with higher awareness of privacy obligations (51%)

- Those who perceived complying with Canada’s privacy laws as easy or difficult (49%)

- Those who expressed concern over a data breach (43%).

Compliance

This section explores perceptions related to the difficulty of complying with Canada’s privacy laws, including barriers to compliance.

Privacy Compliance Seen as Neither Easy nor Difficult

Business executives were asked how difficult it has been for their company to bring their personal information handling practices into compliance with Canada’s privacy laws (using a 7-point scale: 1 = extremely easy, 7 = extremely difficult). The largest proportion (41%) were neutral, viewing this as neither easy nor difficult. Most of the rest (38%) rated compliance with Canada’s privacy laws as easy, while 13% felt that this was difficult for their company.

Text version

Figure 17: Perceived Difficulty of Compliance

Q: How difficult has it been for your company to bring your personal information handling practices into compliance with Canada’s privacy laws?

| Perceived Difficulty | % |

|---|---|

| Extremely easy (1 or 2) | 31% |

| 3 | 7% |

| Neither easy nor difficult (4) | 41% |

| 5 | 8% |

| Extremely difficult (6 or 7) | 6% |

Base: n = 1006; All respondents

Don’t know/No Response= 7%

Subgroup Variations

The likelihood of reporting that it has been very easy (1-2) to bring their personal information handling practices into compliance with Canada’s privacy laws was higher amongst companies in core industries (35%) and those who reported being relatively aware of their privacy obligation (37%). It was lowest amongst those who perceived protecting privacy to be relatively unimportant (20% vs. 32% to 37% of companies that are neutral or privacy or see it as important).

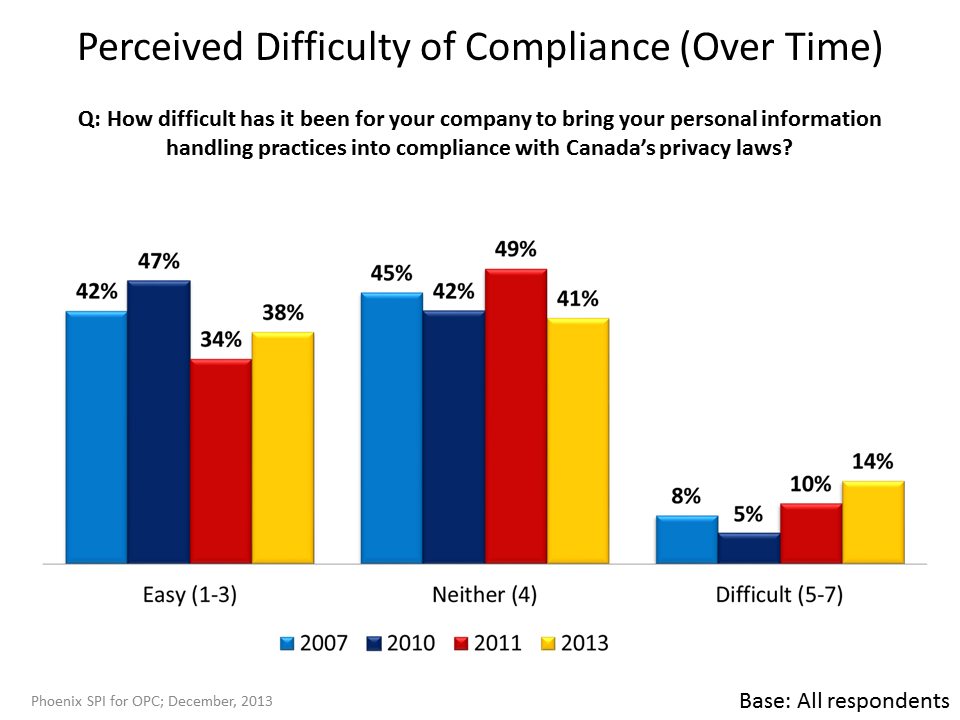

Over time, the perceived difficulty of bringing personal information handling practices into compliance with Canada’s privacy laws has increased modestly, while the perception that it is very easy has decreased. In total, 38% of business representatives currently think it is easy to comply with privacy laws—down from a high of 47% in 2010, but up slightly from 34% in 2011.

Text version

Figure 18: Perceived Difficulty of Compliance (Over Time)

Q: How difficult has it been for your company to bring your personal information handling practices into compliance with Canada’s privacy laws?

| Perceived Difficulty | 2007 | 2010 | 2011 | 2013 |

|---|---|---|---|---|

| Easy (1-3) | 42% | 47% | 34% | 38% |

| Neither (4) | 45% | 42% | 49% | 41% |

| Difficult (5-7) | 8% | 5% | 10% | 14% |

Base: All respondents

Lack of Understanding of Legislation—Top Barrier to Compliance

A lack of understanding of privacy legislation was identified most often (17%) as the most significant barrier or challenge in terms of complying with Canada’s privacy laws. Eight percent or less cited a number of other barriers: staff/personnel time needed (8%), cost of compliance (other than staff) (7%), making sure employees comply (6%), the need to keep their knowledge up to date (5%), and keeping the information secure (4%).

Text version

Figure 19: Barriers to Compliance

Q: In your view, what is the biggest barrier or challenge in terms of complying with Canada’s privacy laws?

| Barriers | % |

|---|---|

| Don't have a clear understanding of the legislation | 17% |

| Staff/personnel time needed | 8% |

| Cost of compliance (non-staff costs) | 7% |

| Making sure/ enforcing employees to comply | 6% |

| Knowledge/keeping up to date | 5% |

| Keeping the information secure | 4% |

| Awareness/information provided (general) | 3% |

| Storing the information (general) | 1% |

| Other | 3% |

| Nothing/no barrier | 15% |

Base: n = 1006; All respondents

Don’t know/No Response= 39%

Examples included in the ‘other’ category, each cited by 2% or less were: keeping up to date with the law; too much paperwork/bureaucracy; barriers to accessing information; difficulties with consistently implementing policy; customer awareness; and the volume of information to protect. Fully 39% did not offer a response to this question.

Breaches

This section explores issues related to data breaches.

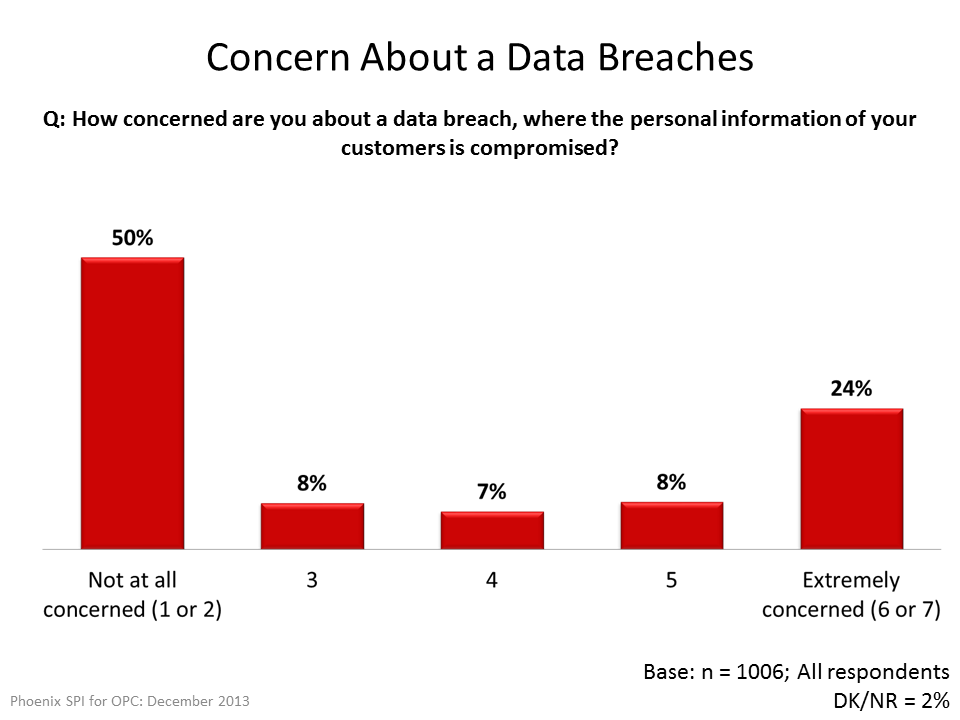

Polarized Levels of Concern Over Data Breaches

Surveyed executives were asked to rate their level of concern about a data breach, where the personal information of their customers is compromised. They were asked to use a 7-point scale (1 = not at all concerned; 7 = extremely concerned). Exactly half (50%) said they were not at all concerned about a data breach, while 24% said they were extremely concerned. In total, exactly one-third offered scores above the mid-point of the scale, suggesting moderate concern about a data breach.

Text version

Figure 20: Concern About a Data Breaches

Q: How concerned are you about a data breach, where the personal information of your customers is compromised?

| Concern | % |

|---|---|

| Not at all concerned (1 or 2) | 50 % |

| 3 | 8 % |

| 4 | 7 % |

| 5 | 8 % |

| Extremely concerned (6 or 7) | 24 % |

Base: n = 1006; All respondents

Don’t know/No Response= 2%

Before being asked this question, executives were provided with the following information:

Sometimes, sensitive personal information that is held by a company about their customers is compromised. This can be due to a range of things, such as criminal activity, theft, hacking, or employee error, such as misplacing a laptop or other device.

Subgroup Variations

The likelihood of being very concerned (6-7) about a data breach was highest amongst:

- Companies located in Quebec (35%)

- Those who perceived protecting privacy as being relatively important (28%)

- Those who reported being relatively aware of their privacy obligation (30%).

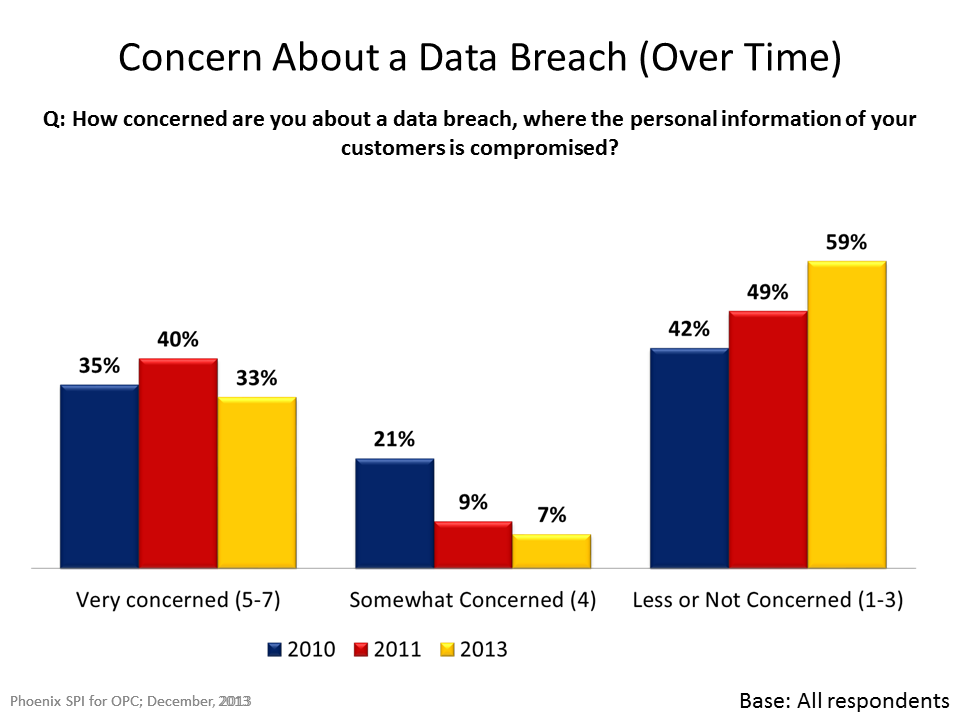

Over time, Canadian businesses have become somewhat less concerned about a data breach. Compared with 2011, the 2013 survey indicates a decrease in the proportion of businesses that are very concerned over such a breach (33% vs. 40%), as well as those who are moderately concerned (7% vs. 9%). As a result, those with little or no concerns have increased to 59% from 49% in 2011 and 42% in 2010.

Text version

Figure 21: Concern About a Data Breach (Over Time)

Q: How concerned are you about a data breach, where the personal information of your customers is compromised?

| Concern | 2010 | 2011 | 2013 |

|---|---|---|---|

| Very concerned (5-7) | 35% | 40% | 33% |

| Somewhat Concerned (4) | 21% | 9% | 7% |

| Less or Not Concerned (1-3) | 42% | 49% | 59% |

Base: All respondents

Top Threats Leading to Breach: Hacking, Theft and Employee Error

Surveyed executives were asked to think about the possibility of a data breach occurring at their company, where personal information is potentially compromised, and to identify what they think represents the greatest threat of this happening. Heading the list were hacking (24%) and theft (19%). In addition, 11% identified employee error. A number of other potential threats were identified by small numbers (3% or less).

Text version

Figure 22: Perceived Sources of Data Breaches

Q: When you think about the possibility of a data breach occurring at your company, where personal information is potentially compromised, what do you think represents the greatest threat of this happening?

| Perceived Sources | % |

|---|---|

| Hacking | 24% |

| Theft | 19% |

| Employee error | 11% |

| Internal breach (e.g. disgruntled employee) | 3% |

| Loss | 2% |

| Break-ins/physical vandalism | 2% |

| Human error/negligence | 2% |

| External breach (e.g. third party) | 2% |

| Use of mobile devices | 1% |

| Server breach (unspecified) | 1% |

| Firewall failure/computer virus | 1% |

| Other | 1% |

| Nothing/no threat | 5% |

Base: n = 1006; All respondents; Multiple responses accepted

Don’t know/No Response= 25%

Five percent of surveyed executives indicated that they could think of no threats, while 25% did not provide a response.

More Than Half Do Not Have Guidelines for Responding to Breach

Fifty eight percent of surveyed companies do not have guidelines in place in the event of a breach where the personal information of their customers is compromised and 5% were unsure. Conversely, 37% do have guidelines in place.

Text version

Figure 23: Guidelines for Responding to a Breach

Q: Does your company have any protocols or procedures in place that would be followed in the event of a breach where the personal information of customers is compromised?

| Protocols or procedures | % |

|---|---|

| Yes | 37% |

| No | 58% |

| Don’t know/No Response | 5% |

Base: n = 1006; All respondents

Subgroup Variations

The likelihood of having protocols or procedures in place that would be followed in the event of a breach was highest amongst:

- Companies in the GTA (53%) and Alberta (48%)

- Companies with at least 100 employees (53%)

- Companies in core industries (45%)

- Those who perceived protecting privacy as being relatively important (43%)

- Those who reported being aware of their privacy obligations (47%)

- Those who reported being relatively concerned over a data breach (44%).

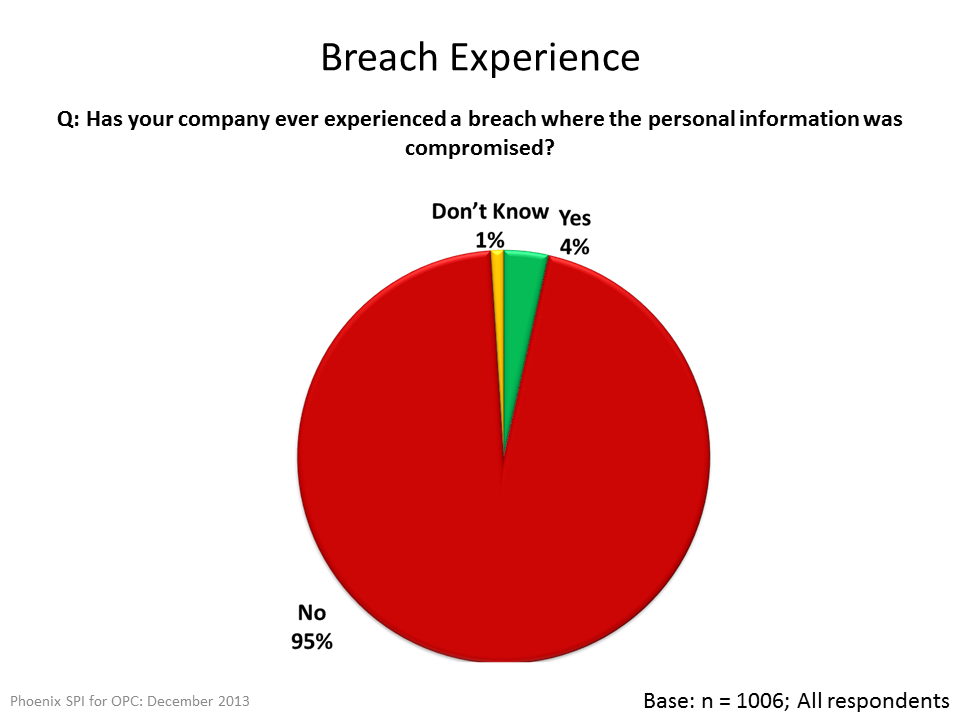

Relatively Few Say They Have Ever Experienced a Breach

The vast majority (95%) of businesses say they have never experienced a breach where the personal information of their customers was compromised. Conversely, only 4% have (1% were unsure).

Text version

Figure 24: Breach Experience

Q: Has your company ever experienced a breach where the personal information was compromised?

| Breach Experience | % |

|---|---|

| Yes | 4% |

| No | 95% |

| Don’t know/No Response | 1% |

Base: n = 1006; All respondents

Subgroup Variations

Larger companies were more likely than smaller ones to report having experienced a data breach where the personal information was compromised (11% of companies with at least 100 employees vs. 1% and 5% of small- and medium-sized companies).Footnote 5

The proportion of companies who have guidelines in place to respond to a breach has increased modestly since 2011 (31%) and 2010 (34%)Footnote 6. The number of companies (4%) who have actually experienced a data breach has remained virtually unchanged since 2011 and 2010 (3% each).

Text version

Figure 25: Guidelines for Responding to Breach and Breach Experience (Over Time)

Q: Does your company have any guidelines in place in the event of a breach where the personal information of your customers is compromised?

| Year | % |

|---|---|

| 2010 | 34% |

| 2011 | 31% |

| 2013 | 37% |

Base: All respondents

Q: Has your company ever experienced a breach where the personal information was compromised?

| Year | % |

|---|---|

| 2010 | 3% |

| 2011 | 3% |

| 2013 | 4% |

Base: All respondents

In total, fifty-two respondents said their company had experienced a breach. The most common steps taken by these companies to address the situation was notifying individuals who were affected, followed by resolving the issue with the individual responsible for the breach and enhancing their security system. Others said they provided training to their staff, reviewed their privacy policy, notified law enforcement, notified the relevant government agencies, took legal action, obtained information from the government, or notified relevant departments within the company. Eight percent of companies pursued other means of addressing the breach.

Corporate Innovation

This section addresses companies’ use of third parties for processing, storage, and other services with relation to customers’ personal information.

Policies in Place to Assess Privacy Risks

When asked whether their companies have policies in place to assess privacy risks related to their business, approximately two-thirds (67%) said that they do not, while 5% were uncertain.

Text version

Figure 26: Policies in Place to Assess Privacy Risks

Q: Does your company have any policies or procedures in place to assess privacy risks related to your business? This includes assessing privacy risks associated with the development or use of new products, services, or technologies.

| Policies or procedures | % |

|---|---|

| Yes | 28% |

| No | 67% |

| Don’t know/No Response | 5% |

Base: n = 1006; All respondents

Subgroup Variations

The likelihood of a company having policies or procedures in place to assess privacy risks was highest amongst:

- Companies that sell to both consumers and businesses (33%)

- Larger companies (46%)

- Companies in core industries (32%)

- Those who perceived protecting privacy as being relatively important (32%)

- Those who reported being relatively aware of their privacy obligation (35%).

Use of Third Parties to Manage Personal Information

Only 13% of surveyed businesses send customer’s personal data to a third party for processing, storage or other services. Of this 13%, 59% claimed to be aware that when a company transfers personal information to a third party for processing, storage or other services, which can include the use of cloud computing, that a company remains accountable for that information. Conversely, 36% were not aware of this accountability.

Text version

Figure 27: Use of Third Party for Handling of Personal Information

Q: Does your company collect personal information from customers and send it to another company for processing, storage or other services, which can include the use of cloud computing?

| Use of Third Party | % |

|---|---|

| Yes | 13% |

| No | 86% |

| Don’t know/No Response | 1% |

Base: n = 1006; All respondents

Q: Have you put in place a contract, or other means, to ensure there is appropriate protection for your company’s personal customer information that is processed or stored by another company, including through cloud computing?

| Appropriate protection | % |

|---|---|

| Yes | 59% |

| No | 36% |

| Don’t know/No Response | 5% |

Base: n = 1006; All respondents Base: n = 152; Those who use third parties

Subgroup Variations

The likelihood of a company sending their customers’ personal information to another company for processing, storage or other services was highest amongstFootnote 7: companies with at least 100 employees (24%) and companies in core industries (16%).

In 2013, a larger proportion (13%) of companies used third parties than in 2011 (9%). However, this is still down from 2010 when 18% of respondents said a third party is responsible for handling personal information.Footnote 8

Text version

Figure 28: Use of Third Party for Handling of Personal Information (Over Time)

2010: Does your company collect personal information from clients and send it to another company within Canada for processing?

In 2010, 1% said they sent personal information to another company outside Canada for processing.

2011 & 2013: Does your company collect personal information from customers and send it to another company for processing, storage or other services?

| Year | % |

|---|---|

| 2010 | 18% |

| 2011 | 9% |